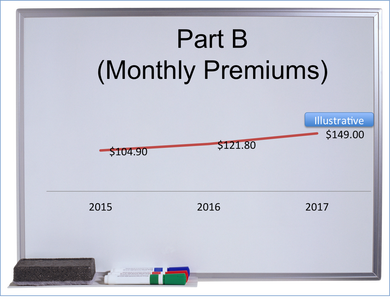

Last year at this time, there were projections of a 50% increase in Part B premiums from $104.90/month up to $159/month. There was a lot of push-back and lobbying against this high of an increase - the end result was a 16% increase to $121.80/month in 2016. This increase only impacted certain groups of people due to the "hold harmless provision". Read more about which groups were impacted here. For 2017, some are projecting an increase up to $149/month for individuals that are not held harmless - those not currently taking their Social Security benefits and in the first income tier (currently <$85k/year MAGI for single, <$170/year MAGI for filing joint returns). If an individual is currently taking Social Security benefits (and in the first income tier), the Part B premiums cannot increase at a greater rate than the Social Security COLA due to the 'hold harmless provision". So what does this all mean? At this point - not much. It is just a guideline for what "could happen". The government didn't actually finalize the 2016 changes until Oct 30, 2015 so it's very possible we may not know the final decision on Part B premiums (or deductibles) until the end of October again. If you Part B premiums do increase, it is a great time to shop for the best Medicare Supplement available to make sure you offset any increases in premiums with some savings with your Medicare Supplement. People switching from a Plan F to a Plan G save an average of $500-600/year in premiums and the only difference in coverage is the Part B deductible ($166 in 2016). If you would like a FREE quote for a Plan G to see if you have the best value, Call now (1-908-272-1970) Cranford Office or (1-856-866-8900) Moorestown Office

0 Comments

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed