|

According to Social Security, about 21% of married couples, and 45% of unmarried persons rely on Social Security for 90% of their income. This is clearly concerning since Social Security was only intended to provide about a third of your retirement income needs (other two thirds was supposed to be individual savings, and pensions).

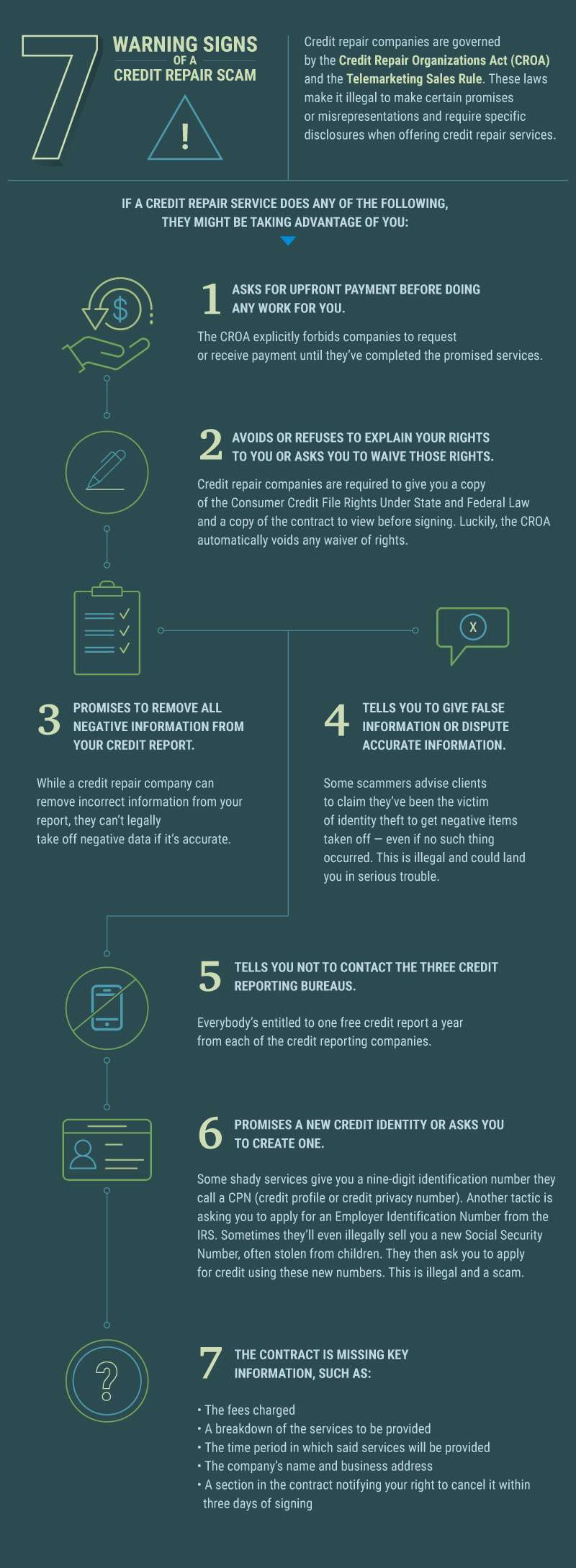

For a lot of retirees, this limited income combined with debt can result in some Credit issues. If you happen to have credit issues, there are numerous providers out there that claim to be able to help repair your credit. It can be difficult to filter through the different options, understand the different services & costs involved. There are also numerous Credit Repair Scams to avoid! Money.com recently published a good article that outlines the 6 best credit repair companies with costs and benefits of each service. The article also does a good job explaining Credit Repair Scams.

3 Comments

9/13/2022 09:57:39 pm

I know In order to choose the right credit card, it is important to be aware of the different types of credit cards available and what each one offers.

Reply

1/7/2023 04:28:26 am

Sometimes I get confused when it comes to credit but your post has been very helpful. I hope you continue to make great content like this. I have been following your blog for quite some time and I must say, you blog inspired me to get mine. You can <a href="https://www.craftsfit.com/how-to-build-a-credit-score-with-a-credit-card/">checkout mine here</a> or https://www.craftsfit.com/how-to-build-a-credit-score-with-a-credit-card/

Reply

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed