|

Let me start this article with a couple of disclaimers:

Over the past several months, we have seen an increased number of Provider billing issues. Medicare Insurance is already quite complex and if Providers are billing incorrectly, this can create additional angst and financial stress for Medicare beneficiaries. Additionally, there are a certain percentage of individuals who just pay these incorrect bills (because they think they really owe them) and never know that they were erroneous bills. Three recent examples that will be highlighted are summarized below.

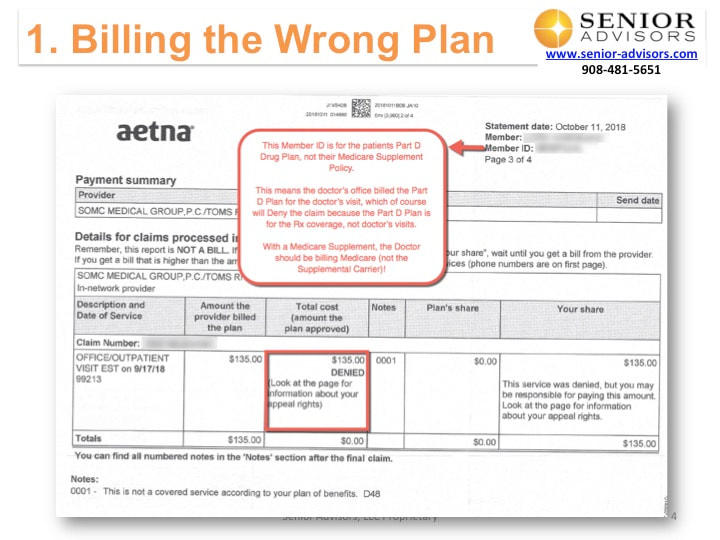

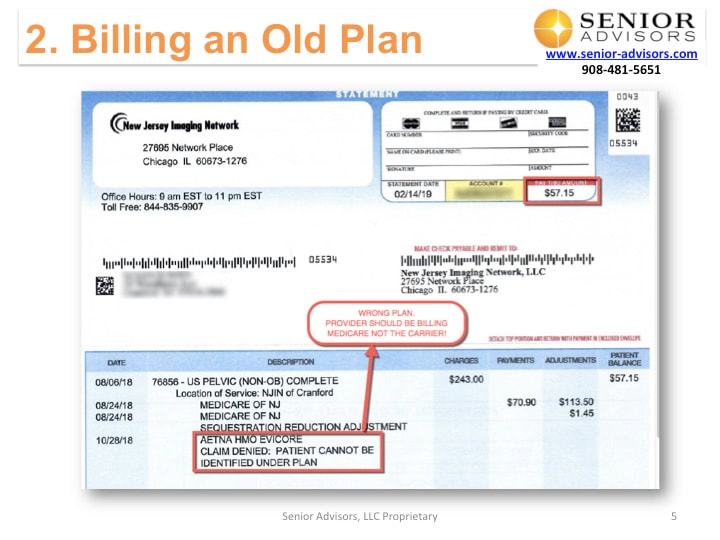

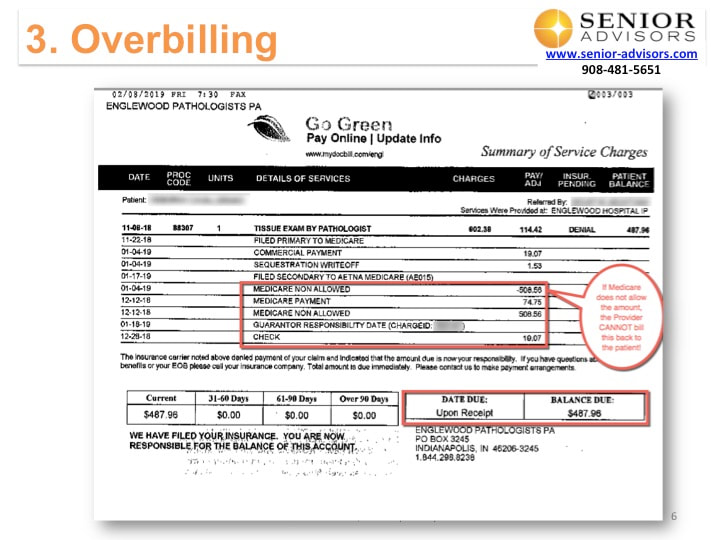

The first example is a situation in which one of our clients received a bill and an Explanation of Benefits from their Insurance carrier showing that a Claim was denied and the individual owed the Provider $135 for the doctor's visit. This client happens to have a Medicare Supplement Plan G, so they are responsible for the Part B deductible ($183 in 2018). So, my first question is always "Did you already meet the Part B deductible?" If the individual didn't reach the Part B deductible yet, than it would be conceivable that they could owe $135 for the doctor's visit. However, the client confirmed they had already reached the Part B deductible for the year. The next step of Troubleshooting is to get a copy of the bill and/or Explanation of Benefits (EOB). In this case, the client had the EOB handy so they emailed us a copy of the EOB (see image above). The language on the EOB stated that the claim was "DENIED", which is unusual. If Medicare pays for a service, the Medicare Supplement MUST pay its portion of the service. However, after reviewing further, we noticed the MEMBER ID that was billed by the Provider's office was the Member's Part D Drug Plan. Therefore the Part D Plan denied the claim because Part D Plans do not cover doctor's visits. The Provider office incorrectly billed the Part D Drug Plan instead of billing Medicare. For all patients that have original Medicare with a Medicare Supplement, the Provider should NEVER be billing the Supplemental carrier. The Provider just needs to bill Medicare. Medicare will pay the Provider its portion of the bill, and then Medicare will send the remainder of the Bill to the Secondary/Supplemental carrier to pay its portion of the bill. If there is any remaining charges (e.g. if the Part B deductible has not been met yet), the Provider will send a legitimate bill to the Patient. After explaining this error to the Provider, the Provider sent the bill to Medicare and they payments were resolved by Medicare and the Supplemental Carrier. Our client owed nothing. The second example deals with another client who also has a Plan G Medicare Supplement. This client already reached her Part B deductible ($183 in 2018), and still received a bill for $57.15. The bill indicated "CLAIM DENIED" by "AETNA HMO EVICORE". This client does not have an HMO Plan. The client has Original Medicare and a Medicare Supplement. The bill looks like the Provider billed Medicare correctly, but then the Provider sent another bill to a carrier "Aetna HMO Evicore", which is not the correct behavior. With a Medicare Supplement, Medicare sends the remainder of the bill to the Secondary/Supplemental carrier to pay its portion of the bill. In this case, the Provider attempted to bill the Insurance company based on an old Plan that the Patient no longer has. The reason the CLAIM was denied is because the Plan that was billed is no longer valid for this Patient. After following up with the Provider, the client was told the claim would be reprocessed and not to worry about the bill. The third example is the most concerning. One of my Medicare Supplement Plan G clients recently received a medical bill from 2018 for $487.96.

How could this be??? The Part B deductible is only $183. So even if the individual had not reached the Part B deductible (which they already had), the highest bill they should have received in 2018 was $183. After further review of the bill and verification with the Medicare Supplement carrier, we can see that Medicare actually only approved about $95 of the $602 billed amount. Additionally, Medicare paid its portion of the bill ($74) and the Supplemental carrier paid its portion of the bill ($19). Thus the Provider has been fully compensated for the services provided based on the Medicare approved rates. The Provider is not allowed to balance bill a patient that has Original Medicare. If Medicare only approves $95, the Provider cannot bill the patient the additional $487.96!! Unfortunately, this case is still not resolved. The client tried calling the Provider's office several times with over an hour wait time. The client tried calling their doctor as well and was not able to get the billing issue resolved. The next step is for the client to file a complaint with Medicare which should help drive resolution to this issue.

4 Comments

Jo Ann Garrett

2/25/2019 11:08:01 am

Is G better than F?

Reply

Justin Lubenow

2/25/2019 01:24:42 pm

Hi there!

Reply

11/11/2021 10:08:25 pm

I’ve been surfing the web for more than an hour today, yet I was unable to find any stunning articles like this one. It’s alluringly worth it for me. Keep posting more such amazing blogs.

Reply

5/10/2023 04:36:37 am

Great blog post on "Don't Pay That Bill"! It's alarming to know that many seniors fall prey to scammers who pose as Medicare representatives and ask for personal information or money. The tips provided in the article are incredibly useful in protecting oneself from such fraudulent activities. I appreciate the author's emphasis on the importance of reviewing and understanding Medicare Summary Notices (MSN) to identify any suspicious charges or services. Overall, this post is a timely reminder for seniors to be vigilant and proactive in safeguarding their finances and personal information.

Reply

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed