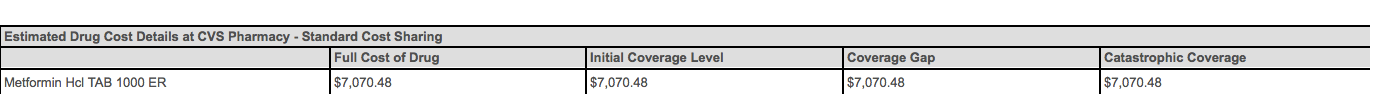

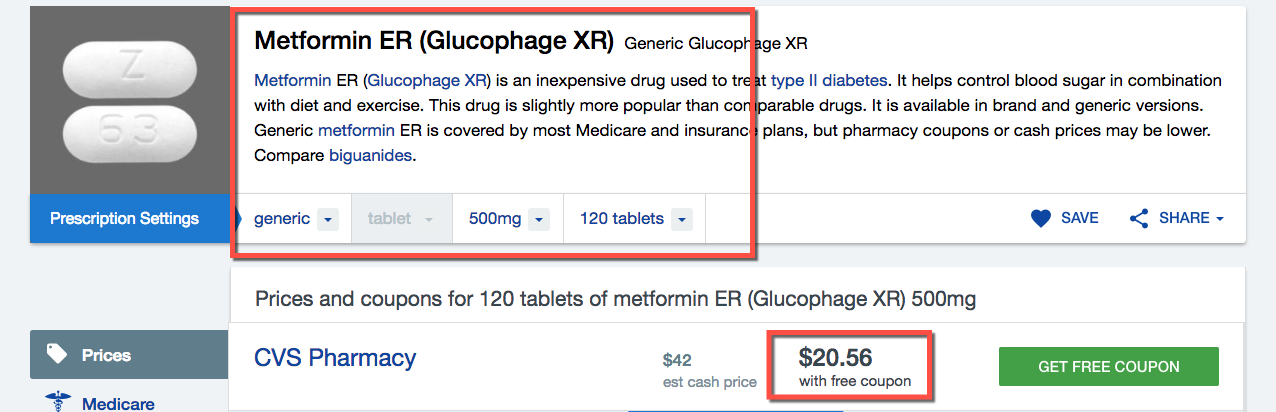

There is something terribly wrong with Pharmaceutical pricing in our country. Pharmaceutical costs continue to spiral out of control. I have a client ("Susie") who is starting on Medicare for 10/1/2017. A few weeks ago when we reviewed her Prescription costs, she was taking Metformin HCL 1000mg, which is only about $6.50/month retail cost. This is a very reasonable price for a generic drug used to treat a chronic condition like Type 2 diabetes. Recently, Susie had been having some stomach discomfort with the Metformin 1000 HCL so her doctor prescribed her same medication in an Extended Release (ER) form (Metformin HCL 1000mg ER) to minimize the impact on her stomach. On Susie's current group health insurance plan, her copay for the new medication (Metformin HCL 1000mg ER) went up from about $5/month to $30 per month. This was manageable and well worth it since the ER pills reduced/eliminated her stomach discomfort. Last week, Susie notified me of her medication change (from Metformin HCL 1000 mg to Metformin HCL ER 1000mg), so we could re-run her Part D analysis before she goes on Medicare for 10/1/2017. I was absolutely shocked when I updated her medication list on Medicare.gov and saw: (a) the Metformin HCL ER 1000mg was not covered on her Part D formulary (b) the monthly retail cost for the Metformin HCL ER 1000mg was $7,000+ per month!! I figured this had to be a mistake. I called Humana (her Part D Plan) to see what the cost would be for this Metformin ER 1000mg if Susie applied for an Exception to the formulary. The Humana representative said she could probably get an exception to the formulary due to the side effects with the regular Metformin HCL 1000mg. However, Humana is unable to tell us what the cost of the Metformin ER 1000mg will be since it is not listed in their formulary. Additionally, even if Susie is able to get the exception to the formulary, the retail cost of the Metformin 1000mg ER medication will still put her into the "Donut Hole" of Part D (watch this video to learn more about the donut hole) within her first month. The net impact is going from about $60/year in copays for the regular Metformin 1000mg up to $4,000-$5,000 per year in out of pocket costs for the Metformin ER 1000mg. My frustration builds... how could the exact same medication in a regular release versus an extended release be $7,000 per month difference in cost? I still didn't believe the cost difference was accurate. My next phone call was to CVS to see what the cash price would be to purchase the Metformin HCL ER 1000mg. Again, I was shocked to hear it would be $4,000-$6,000 per month to purchase this medication without insurance. This seemed to validate the retail cost of the Metformin HCL ER 1000mg really is thousands of dollars per month! GoodRx has Metformin ER for only $20/month?!?I was not willing to give up yet! I continued to try to figure out a cost effective way for my client to get her medication. My next step was to check-out GoodRx.com to see if they had any coupons for the Metformin ER 1000mg. I couldn't find the 1000mg ER version, but they did have coupons for the 500mg and 750 mg ER tabs which resulted in a cost of only about $20/month (500mg x 120 tablets per month). I thought, "Wow, what a great deal!! A $7,000 / month drug for only $20/month with the GoodRX coupon." I sent the coupon over to Susie and the plan was to use the coupon at CVS and pay $20/month for the 120 tablets of 500mg Metformin ER HCL (after her doctor updated her prescription from 60 tablets of 1000mg ER). This would help her avoid the Part D Donut Hole and keep her copays reasonable for the Metformin ER. When Susie received the GoodRX coupon, she did some digging herself on GoodRX and found her Humana Plan WOULD cover the Metformin Hcl 500mg ER and the copay would only be about $5/month. She sent this info back to me and again, I was surprised. We had checked the Metformin 1000mg ER Hcl and it was NOT covered by the Humana formulary. I went back to Medicare.gov to update the dosage and see the impacts. Back to Medicare.gov - 500mg ER is covered and only $6.50Sure enough, after updating the medication list on Medicare.gov, the Metformin Hcl ER 500mg IS covered by the Humana formulary and costs < $10/month. Without entering every single dosage of Metformin (about 10 variations) in the tool on Medicare.gov, there would be no way to know that the 500mg ER is only $6.50 / month even though the 1000mg ER is $7,000+ / month. Now, Susie's plan changed again to use her Humana Part D Plan with the Metformin Hcl 500mg ER medication. This needs to be fixed...This example may be tough to follow because it was incredibly confusing as we experienced it as well. How could the same exact medication in different releases (1000mg HCL vs. 1000mg HCL ER) be $7,000 per month difference in cost? How could the same exact medication in difference dosages (500mg ER x 120 tablets vs 1000mg ER x 60 tablets) be $7,000 per month difference in cost?? I am certain not everyone has an advocate, like Senior Advisors, to help find a cost-effective solution to this program. Some indivduals would pay thousands of dollars per year extra for their medication. This needs to be addressed. As a member of the Medicare Advisory Group for the National Association of Health Underwriters, I will be escalating this issue/example to see if we can get some improvements to these types of price gouging examples with Pharmaceutical drugs. One other key point - Susie's copay only $30 on the Group Plan?One of the main reasons health insurance premiums are so ridiculously high and continue to rise at astronomical rates is because of these types of Pharmaceutical costs.

Remember in Susie's example she was only paying $30/month copay for the Metformin Hcl 1000mg ER on her Group Health Insurance Plan. If the retail cost of this medication is $7,000 per month, how is her copay only $30/month. Well, the Insurance company is paying the cost differential for the medication. And we all know Insurance companies are for-profit companies which means the additional cost incurred will need be offset in the Monthly Premiums that are being charged for the insurance. The consumer is somewhat oblivious to these situations with Group Health Insurance (unless they are on a High-Deductible health plan which requires them to pay the full cost of the medication), since the copay is only $30/month. What the consumer doesn't realize is the REAL cost is $7,000 per month and this cost will end up being factored in to the next year's premium increase for the Group Health Insurance plan. If there is someone out there that works for a pharmaceutical company and can explain this Metformin ER 1000mg price difference to me, I would be happy to have a healthy debate on this topic... feel free to comment below or shoot me an email with your thoughts (justin@senior-advisors.com)

7 Comments

Melva Romano

9/30/2017 11:13:46 pm

Thank you Justin for being so diligent. My husband Pasquale is a client of your father's. Thank you for the informative articles. I have read the article about PAAD assistance that we were not aware of. I believe my husband maybe qualified for.

Reply

Justin Lubenow

10/1/2017 07:15:45 am

Hi Melva - I am glad you find the articles useful. Let me or Doug know if you have any further questions. Best, Justin

Reply

12/2/2017 03:32:05 pm

I just read your article about Metformin and really wasn't as shocked as one would think.

Reply

Mikel

3/11/2021 01:01:45 pm

Has anyone checked if Susie is eligible for any outside programs? This could be like Medicaid help, RX "extra help," even the drug manufacturers? Secondly, Canadian drugs are just like American ones. Another option.... take 2 500 ER, which equals 1000. a doctor can easily ask for the RX to be filled as exact. Some other hospital programs do help with meds and costs. I was on one before. Also, the Diabetes Foundation should have also been consulted. They may even have ideas or programs. If all else fails, your local health department/district could have some pull for med help.

Reply

Justin Lubenow

3/11/2021 04:46:35 pm

Hi Mikel,

Reply

Erin

2/6/2023 05:11:38 pm

I just discovered your post when trying to research this myself. I've been struggling to get the exact medication covered by corporate health insurance plans for over a year now. I cannot take the 500mg generic - the medication isn't doing its job, and I can't even begin to understand why because I don't work in biochemistry and don't have a pharmaceutical degree. What I can tell you is that I work for McKesson and their PPO group policy (prescription is through Caremark) where I pay $1000/mo in premiums for group medical insurance for me and my family doesn't cover it either. I'm going through the appeals process now, but I am losing hope. I don't have my medication at the time of leaving this comment and no way to get it without paying $18,400 out of pocket for my 90-day supply. AND I WORK FOR MCKESSON SUPPORTING THE COVERMYMEDS BUSINESS UNIT. Talk to me about insanity. If I can't get it under my PPO policy with McKesson who makes billions on software solutions claiming to bridge the gap of medication access and adherence between patients and pharmaceutical companies, Medicare patients have no hope.

Reply

Justin Lubenow

2/6/2023 06:01:47 pm

Erin - I am very sorry to hear about your current situation. The root problem in this situation is the exorbitant price the manufacturer is charging for a specific dosage of a generic medication to treat a chronic condition like diabetes. It's really quite sad. Perhaps if you bring this to the attention of your local Congressman/woman they can provide some guidance/assistance. At a minimum, you can get it on their radar to hopefully address in future legislation.

Reply

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed