|

|

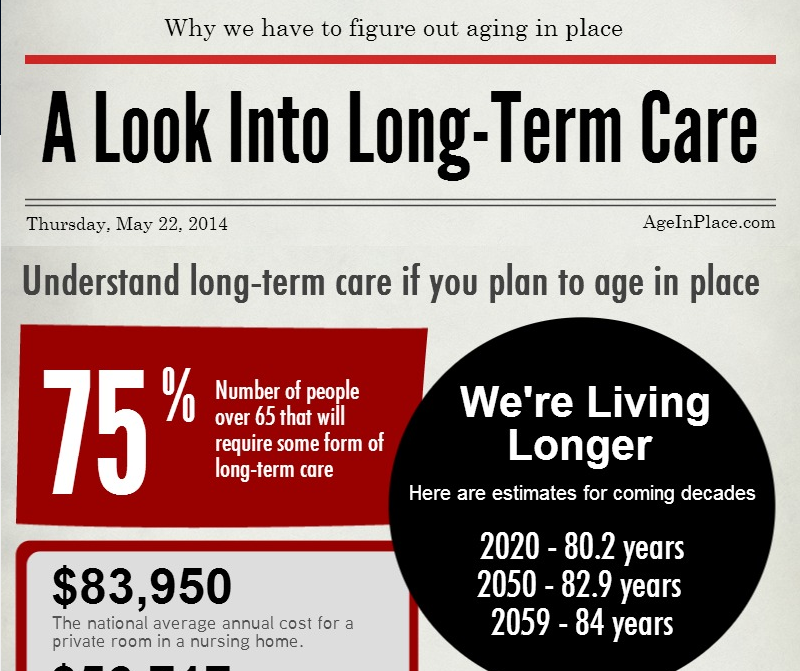

Long term care insurance is the only way to protect your estate from the spend down process and finally ending up on Medicaid. Long Term Care Policies have been around now for over 40 years and have evolved to cover most of the services needed which include: Home health care, assisted care living facilities, adult day care as well as nursing home care. The services covered by these policies are services not usually covered by Medicare. There is a common misunderstanding the Medicare will pay for Long Term Care services. These services can cost $40,000+/year for home health care and $100,000+ per year for a nursing home. The following are the most important things to look for in a Long Term Care Insurance policy.

Monthly Benefit:

Most policies today are starting with a monthly benefit of $5,000 to $6,000 per month. A monthly benefit is much better than a daily benefit. You will have much more flexibility on how benefits are available throughout the month with a monthly benefit. This is especially important for home healthcare.

Inflation Benefit:

This is an essential part of a Long Term Care Policy. The average age that people are purchasing their policies is now 58 years old, so it is very important that some form of inflation is added to the policy. The general rule is that up to mid 60’s you should have a compound inflation rider, from mid 60’s to early 70’s simple inflation will suffice and from mid 70’s just a good monthly benefit is usually recommended, primarily from a cost stand point.

Benefit Period:

The most common benefit periods range from 5 to 6 years. This means that once you qualify for benefits you will have that many years to collect your benefits. Only about 5% of claims actually go longer than 5 years. Claims for dementia and Alzheimer’s can last longer than the 5 or 6 years.

If you are a couple, either married or living together you will be eligible for a couple’s discount. This discount could be as much as 40% on the premium. You may also qualify for a preferred health discount if there are no medical issues.

Long Term Care Partnership:

This is a law which allows you to protect a portion of your estate without spending down to the $2,000 Medicaid requirement. If you have a Long Term Partnership Policy your will be able to protect an amount equal to the amount which the insurance company has paid out for claims. If your policy paid out $500,000 in benefits and you run out of benefits you will be allowed to keep $500,000 in your estate rather than spending down to $2,000. This law was passed to encourage more people to purchase long term care insurance.

Hybrid Options - LTC, Life, and Return of Premium

The premiums for Long-Term Care insurance have significantly increased over the last 5-6 years. In addition to the high cost of traditional LTC, one of the major concerns people have with purchasing Long-Term Care Insurance is that the benefit is "Use it or Lose It". Basically, with a traditional Long-Term Care Policy you could spend 10's of thousands of dollars in premiums over the years and if you happen to pass away before making a claim for the LTC benefit, you don't get any of those premium dollars back.

Today, there are some interesting options which blend LTC benefits, Life Insurance, and Return of Premiums. These plans generally have lower LTC benefits, but the premiums being spent will be used towards Life Insurance and/or a Return of Premium (if you need the cash back at a later point in time).

If you would like to get a quote (or more information) for Traditional LTC or a Hybrid LTC option, you can Submit the form below or give us a call...

Monthly Benefit:

Most policies today are starting with a monthly benefit of $5,000 to $6,000 per month. A monthly benefit is much better than a daily benefit. You will have much more flexibility on how benefits are available throughout the month with a monthly benefit. This is especially important for home healthcare.

Inflation Benefit:

This is an essential part of a Long Term Care Policy. The average age that people are purchasing their policies is now 58 years old, so it is very important that some form of inflation is added to the policy. The general rule is that up to mid 60’s you should have a compound inflation rider, from mid 60’s to early 70’s simple inflation will suffice and from mid 70’s just a good monthly benefit is usually recommended, primarily from a cost stand point.

Benefit Period:

The most common benefit periods range from 5 to 6 years. This means that once you qualify for benefits you will have that many years to collect your benefits. Only about 5% of claims actually go longer than 5 years. Claims for dementia and Alzheimer’s can last longer than the 5 or 6 years.

If you are a couple, either married or living together you will be eligible for a couple’s discount. This discount could be as much as 40% on the premium. You may also qualify for a preferred health discount if there are no medical issues.

Long Term Care Partnership:

This is a law which allows you to protect a portion of your estate without spending down to the $2,000 Medicaid requirement. If you have a Long Term Partnership Policy your will be able to protect an amount equal to the amount which the insurance company has paid out for claims. If your policy paid out $500,000 in benefits and you run out of benefits you will be allowed to keep $500,000 in your estate rather than spending down to $2,000. This law was passed to encourage more people to purchase long term care insurance.

Hybrid Options - LTC, Life, and Return of Premium

The premiums for Long-Term Care insurance have significantly increased over the last 5-6 years. In addition to the high cost of traditional LTC, one of the major concerns people have with purchasing Long-Term Care Insurance is that the benefit is "Use it or Lose It". Basically, with a traditional Long-Term Care Policy you could spend 10's of thousands of dollars in premiums over the years and if you happen to pass away before making a claim for the LTC benefit, you don't get any of those premium dollars back.

Today, there are some interesting options which blend LTC benefits, Life Insurance, and Return of Premiums. These plans generally have lower LTC benefits, but the premiums being spent will be used towards Life Insurance and/or a Return of Premium (if you need the cash back at a later point in time).

If you would like to get a quote (or more information) for Traditional LTC or a Hybrid LTC option, you can Submit the form below or give us a call...