|

Secure Act 2.0 (HR-2954) passed the House of Representatives on March 29, 2022 by an overwhelming majority 414 to 5. This bill is intended to provide additional opportunities for Americans to save for retirement. The short video above some of the key highlights of this bill:

Expand Catch-Up Contributions

Delay Required Minimum Distributions (RMDs)

Mandatory/Automatic Enrollment in Retirement Plans for Employees

Authorize Student Loan Matching for Employers

Secure Act 2.0 provides some interesting incentives to improve retirement savings for individuals.

The Senate still needs to pass a companion bill and then it will need to be signed by the President to become law. We still have some concerns with the lack of focus in Washington on the two large looming financial issues with Medicare (Hospital Trust Fund running out of money to cover expenses by 2026) and Social Security (not able to pay out full benefits by 2034). Hopefully, these important issues are addressed soon in Washington.

0 Comments

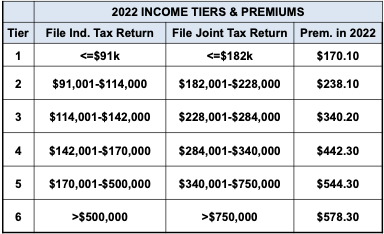

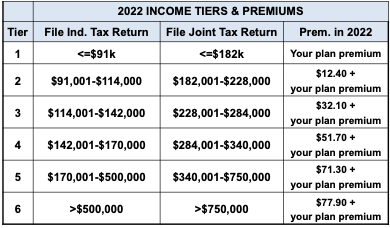

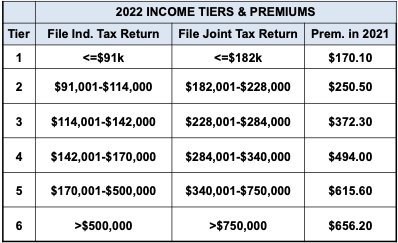

Some people are in for a bit of sticker shock when they enroll in Medicare benefits. Specifically, those in a higher income bracket who are responsible for IRMAAs (Income Related Monthly Adjustment Amounts) for Part B and Part D of Medicare. For the top earners, the Part B Premium and IRMAAs can cost over $600/month (per person) to the government, and this is before adding the premium for a Supplement and Part D Prescription plan. For 2022, the base Part B premium amount is $170.10/month (if your single income is below $91k/year, or joint income is below $182k/year). However, if your income is above the base income amount, you have to pay additional amounts to the government called IRMAAs for both Part B and Part D of Medicare per the tables below. Table 1. Part B Premiums and Part B IRMAAs This table outlines the Part B premium and Part B IRMAA amounts each of the six different income tiers. Table 2. Part D IRMAAs This table outlines the Part D IRMAA amounts each of the six different income tiers. The Part D IRMAA is an additional amount due to the government on top of the Part D premium you have to pay the insurance company for the Part D Prescription coverage. Table 3. Total Part B Premium + Part B IRMAAs + Part D IRMAAs Most of our clients want to know what the total amount they will owe the government will be; so in Table 3 we have just summed the IRMAAs from Table 1 and Table 2 for each of the six income tiers. FAQ: What income is being used to determine the IRMAA?

The government uses the MAGI (Modified Adjusted Gross Income) from the last tax return they have processed to determine the initial IRMAA. For most people, MAGI will be the same as AGI (Adjusted Gross Income), but it is possible the MAGI is higher than AGI. For example, for someone enrolling in Medicare for the first time effective June 1, 2022, the government will check the MAGI from the 2020 Tax return (they haven’t fully processed the 2021 tax returns yet) to determine the IRMAAs (if any) for 2022. Additionally, the government will review tax returns at the end of each year to determine IRMAAs for the following year. For example, in December 2022, the government will send out 2023 IRMAA letters to higher earners based on the MAGI from their 2021 tax returns. FAQ: What if my income dropped because I retired? Do I still have to pay the IRMAA? The government is using the best income information they have to determine the IRMAA, but they understand the system is flawed due to the delay in reporting and processing returns. For this reason, the government allows you to appeal IRMAAs if you had a life changing event (e.g. Work Reduction, Work Stoppage, etc.). If you have a life changing event that will result in your income dropping to a lower income tier (see Table 1), you can complete and submit the form SSA-44 to Social Security to request the IRMAAs be reduced / removed. It is possible you may need to appeal the IRMAA twice (once when you initial enroll and again in December for the following year) due to the delay in tax return timing and processing. In the example mentioned earlier, if you first enroll in Medicare for June 1, 2022 you may need to appeal once for 2022 IRMAAs, and again in December for 2023 IRMAAs (since they will be using the 2021 tax return for 2023 IRMAAs). FAQ: I received my bills from Medicare and they are very confusing. Can you help clarify? For people that are receiving a monthly Social Security check, the Part B premiums and IRMAAs are deducted from the monthly Social Security payment. For those not yet taking Social Security, the government will send quarterly bills for the Part B premiums and IRMAAs. The initial billing for these IRMAAs is incredibly misleading & confusing. Generally, the first quarterly bill only includes the base Part B premium (e.g. $170.10/month in 2022). The second bill is a huge bill because it includes the IRMAAs for the first billing period and the IRMAAs for the second billing period. This second bill sometimes results in confusion and sticker shock. Also the line item detail is not very clear on the bills which creates more confusion. In this situation, the billed amount is generally correct but you have to do some math to back into the numbers. You can take the total amount of the first two bills and divide it by the number of months for the bill periods. This monthly average should align with the monthly amount the person is responsible for based on their income. For example, if someone is in the second income Tier in 2022 ($91k-$114k single income), the correct amount they should be billed is $250.50/month ($170.10/month for Part B, $68/month for Part B IRMAA, and $12.40/month for Part D IRMAA). The first bill this person receives will likely be for three months of just the base Part B premium which is $510.30. The second bill this person receives will likely be for $992.70 (base Part B premiums for the second 3 months + IRMAAs for the first bill and IRMAAs for the second bill). People tend to panic when they see that second bill. In this case, you can add up the total of the two bills ($510.30 + $992.70) = $1,503. Then divide by the number of months billed (in this case 6 months)… to get $250.50/month which matches the correct amount this person should be paying. By the third bill, the amounts should be billed correctly as $751.50 ($250.50 x 3 months). We hope you found this information helpful. If you prefer to watch videos, here is a link to a short video that explains these IRMAAs. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed