|

You may have already seen by now - Social Security released the 2017 Cost of Living Adjustment on Wednesday - the smallest increase in history, 0.3%. This means the average retired worker will receive an additional $4 per month. There are a lot of articles already published on this Social Security increase, and frankly Social Security is not my area of expertise (Medicare is my expertise) so I won't provide too much commentary on the increase. I do recommend you speak to a Social Security expert and/or attend a workshop (see Recommendation #2 below) if you have any questions about Social Security. Impacts on Medicare Part B PremiumsIn 2016, there was no COLA on Social Security. So most Medicare beneficiaries received no increase on their Part B Premiums of $104.90/month due to the "hold harmless" provision. You can read more here about the 2016 changes and the "hold harmless" provision. This small increase in COLA will likely result in a Part B Premium increase for everyone. The 2017 Part B premiums have not been made official yet. There are several articles speculating an increase to $149/month; but last year there were also projections of Part B increases up to 50% and the end result was only 16%. Last year, the changes were not finalized until the second week of November so we may have to wait a few more weeks to get the final 2017 numbers. Recommendation #1: Review Your Medicare Plans Now, is the perfect time to be reviewing your Medigap and Part D Plans to ensure you have the most effective solution. This is your one opportunity (Oct 15 - Dec 7) each year to change your Part D Plan for 2017 and make sure you have the best Part D plan based on your specific list of drugs. If you would like a Free RX review and Part D recommendation, you can fill out our online form by November 15 for a free analysis and recommendation. Do you still have a Plan F Medigap Plan?You should definitely be aware of the impacts to Plan F in 2020 (just about 3 years away), and the potential savings with a Plan G Medigap Plan. We represent all the major insurance companies in the country and can let you know the best rates for each carrier based on your current age & situation. We can also let you know if you would qualify for a Plan G with a short 5 minute phone call. We are saving individuals an average of $600 per year and couples an average of $1300 per year switching from a Plan F to a Plan G supplement. Give us a call now or you can request a quote from our online form. Call now (1-908-272-1970) Cranford Office or (1-856-866-8900) Moorestown Office Recommendation #2: See an Expert to Maximize your Social Security BenefitsAs I mentioned before - I am not a Social Security expert. But, I work closely with several Social Security experts and would highly recommend that you attend an educational workshop to ensure you understand ways to maximize your Social Security Benefits.

There are two workshops coming up in Red Bank, NJ on November 5 Workshop and November 10 Workshop . The AFEA presenter, Greg Dillon is a colleague of mine and an excellent Social Security resource. I highly recommend you attend if you have any questions about Social Security benefits.

0 Comments

There is an important provision with Medicare Part A Benefits that is creating unexpected bills for some Medicare Beneficiaries. Most people understand that Medicare Part A covers Hospital expenses… but Part A also covers Short-Term Skilled Facility Care, up to 100 days (20 days full covered by Part A, Days 21-100 have a copay, which most Medigap Plans pay.)

There is a nuance to qualify for the Short-Term Skilled Facility Care benefit. In order to qualify for this benefit, you must have been “Admitted” to the hospital for at least 3 days, and enter the Medicare-approved Skilled Nursing Facility within 30 days after leaving the hospital. For most people that get hospitalized for three days and need Short-Term Skilled Care, this is not a problem since they have been “Admitted” to the hospital. The people that are impacted are those that were never “Admitted” and kept in an “Observation” status, and then transferred to a Skilled Nursing Facility. These people are given a notice explaining that they will be responsible for the bills at the Skilled Nursing care, but most people are in too much pain/stress to really understand this information at the time. These people end up getting bills for thousands and thousands of dollars that are not covered by Medicare (or Medigap). Why did CMS Create this Rule? There is a great article in philly.com this week, which highlighted some key data points and history related to this rule: “The three-midnight policy was created in 1965 to limit post-hospital care. In 1988, Congress waived the requirement, and Medicare expenditures on skilled nursing home care jumped 243 percent. The requirement was back in place a year later.” So it doesn’t sound like the rule will be changing any time soon. What can you do about this? First, it’s important to at least be aware of this rule. If you (or a loved one) does get hospitalized and then transferred to Skilled Nursing, you should be aware of whether the patient was “Admitted” with a 3-night stay before the transfer. If not, the patient will be responsible for all the bills at the Short Term Nursing Facility. If you want additional coverage for Short-Term Skilled Nursing Care to address these “Observation” situations, give us a call and we can let you know what’s available in your area. Are you aware that the Medicare Annual Enrollment Period started on Saturday, Oct 15?

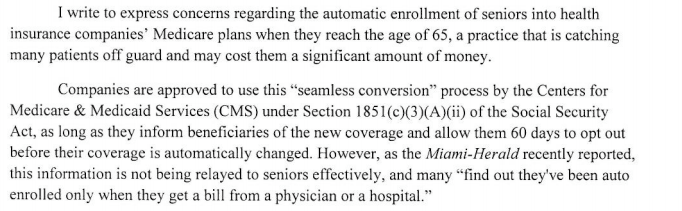

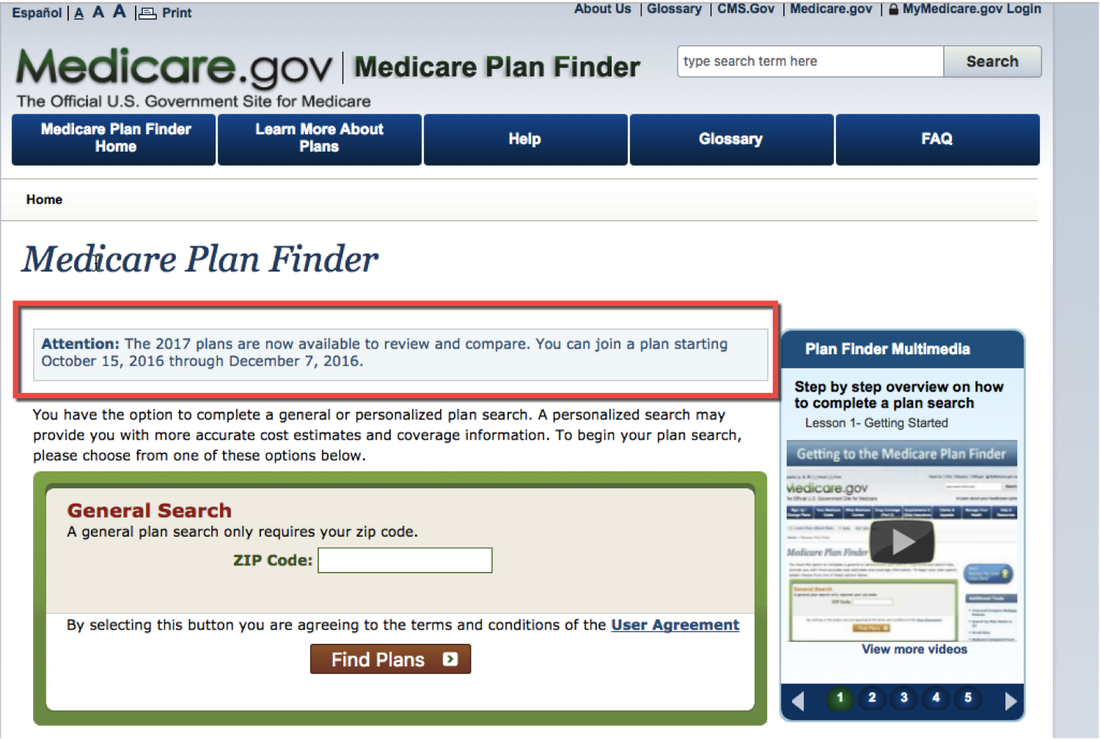

What does this mean for you? If you have a Part D Prescription Plan, this is your one opportunity to review your RX coverage for 2017 and make sure you select the right Part D Plan. We are offering a Free RX analysis if you would like us to review your Part D coverage for 2017. We use a tool on the Medicare.gov website which analyzes all the available Part D plans in your area (~25 per state) and let you know which is the best Part D Plan for you. If you would prefer to do this analysis on your own, you can watch our short video here, which walks you through how to use the tool on Medicare.gov for Part D analysis. If you have a Medicare Advantage Plan, this is also your opportunity to review your coverage and determine if you want to keep your plan (if it's available in 2017), move to another Medicare Advantage Plan, or go back on Original Medicare with a Medigap + Part D Plan.  We anticipate Medicare Beneficiaries receive about 50-60 mailers in the months of October thru December since the Open Enrollment period is Oct 15 – Dec 7. Is your mailbox overflowing yet with Medicare Advantage offers for 2017? We have attempted to sift through all the mail and pull together some of the recent highlights with Medicare Advantage Plans: What happened to my AmeriHealth Medicare Advantage Plan? If you have an AmeriHealth Medicare Advantage Plan in 2016, you should have received a cancellation notice from AmeriHealth. You have the right to choose another Medicare Advantage Plan in 2017 from one of the carriers in your Service Area, which could include UnitedHealthcare/AARP, Aetna, Clover, and others. If you prefer to switch to Original Medicare with a Medigap plan, you have a Guaranteed Issue right to get into a Medigap Plan in 2017, with no medical questions. Call us today to find out more. Auto-enrolled in Medicare Advantage?Did you know that Insurance companies can auto-enroll Medicare Beneficiaries into Medicare Advantage Plans when they turn 65? The Insurance company is required to provide a notification 60 days in advance explaining the coverage details and the impacts of the Medicare Advantage Plan. If you are on an individual insurance plan and turning 65, you should be on the look-out for that notice and may sure you are analyzing all of your Medicare options. Marco Rubio recently wrote a letter to CMS requesting that they improve this communication & process so seniors on not negatively impacted by this auto-enrollment. Snippet from the letter is below. Switch to a Medigap + Part D? If you are not happy with the coverage or network of your Medicare Advantage Plan, the Open Enrollment period is your opportunity to try to switch to a Medicare Supplement. You will likely pay more in premiums for a Medigap plan, but you will have much more robust Medical coverage with limited out of pocket expense. Read more here about the differences between Medicare Advantage and Medicare Supplements. If you have further questions or would like a quote for a Medigap plan,

The Medicare.gov Part D Prescription Analysis tool has now been updated with the 2017 Part D plans.

Even though you can't actually make a change to the Part D coverage until October 15, you can start to review the best Part D Prescription coverage for you in 2017. If you already filled out our form for a Free RX analysis, you should be hearing from us in the next 1-2 weeks with our recommendation for your 2017 Part D plan. We will accept new RX forms up until November 15 for the December 7 enrollment deadline. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed