|

On June 22, 2016, the Medicare Board of Trustees Report was released. The Report provides an overview of the financial status of the Hospital Insurance (HI) and Supplementary Medical Insurance (SMI) was released last week.

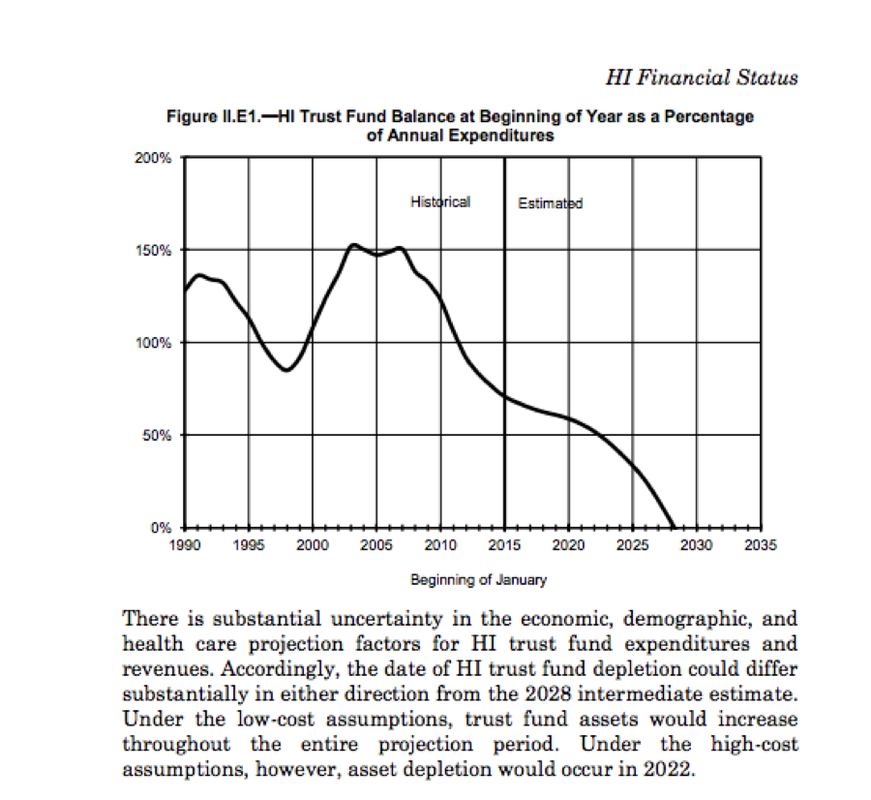

There are endless fascinating details in this report, and the main highlight is the anticipated depletion of the HI Fund by 2028 (two years earlier than anticipated in last year’s report). The SMI trust fund is adequately financed over the next 10 years and beyond because premium income and general revenue income for Parts B and D are reset each year to cover expected costs and ensure a reserve for Part B contingencies.

What's the solution?This will be hotly debated over the next few months during the campaigns and the next few years as legislation gets created. At a high-level, there are four main approaches to attack a fiscal problem like this.

Original Medicare with a Supplement provides amazing Medical coverage with limited to $0 out-of-pocket costs. This is very important for folks on a fixed income to be able to plan out their budget. For this reason, I am not in favor of #1, reducing Medicare benefits. I understand there are certain cases when increased taxes are necessary. I do not believe the HI fund deficit is a situation in which #2, increased Medicare taxes, is the right solution, because of the opportunities with eligibility rules and reduced costs. In my humble opinion, the best option would be a combination of #3 (Change Eligibility rules) & #4 (Reduce Costs). If we start planning now to change the Medicare eligibility rules (e.g. gradually increase the age from 65 to 68), this will have a significant savings impact on the Program and help future solvency of the HI fund (and also stability in Part B & D premiums). I am not suggesting we change the eligibility rules for individuals who are just a few years away from turning age 65, since they do not have time to adjust and plan properly for extra years of pre-Medicare Medical coverage. I am suggesting we change the Medicare eligibility age for individuals that have 10 + years to plan for this change. This should be plenty of time to make adjustments - but the longer we wait on making this change the more difficult it will be to recover the solvency of the fund or give people proper time to plan. With regards to cost reductions, I do not have an exact blueprint - but I do believe there is opportunity to streamline hospital expenses, while continuing to provide high-quality care. Enhancements in technology and operations drive costs out of nearly every industry and I anticipate we will continue to see cost reductions in hospitals as well. Also, Prescription drug costs are another huge opportunity of cost reduction. The U.S. government is not currently able to negotiate the cost of Part B drugs with Pharmaceutical companies. This is a political topic that will be hotly debated. I believe this has to change, since negotiation is part of a successful capitalist economy. I am curious to hear your perspective & solutions - feel free to respond here in the Comments section.

1 Comment

|

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed