|

Over the past few weeks, we have been hosting Medicare Workshops in NJ and we have heard similar comments over and over, when we discussed annual enrollment:

These are common comments and questions for a lot of people. We are here to help you, as we have helped over 15,000 other Medicare customers over the last seven years. For all of our Medicare Supplement customers, we offer a free annual analysis of the RX plan to ensure each individual gets the right plan each year. We have a special promotion right now for to get a Free RX Analysis even if you are not an existing customer. We will shop around the top carriers and provide the best quotes available for your specific situation. Here is a testimonial from a very happy couple in September that we helped with their Medicare Supplement... “Senior Advisors just saved us over $2,000 per year by changing from Plan F to Plan G!” - Ted & Marion, Northfield, NJ See more about Plan F vs Plan G here. Call now for more information! 1-908-272-1970 or 1-856-866-8900

0 Comments

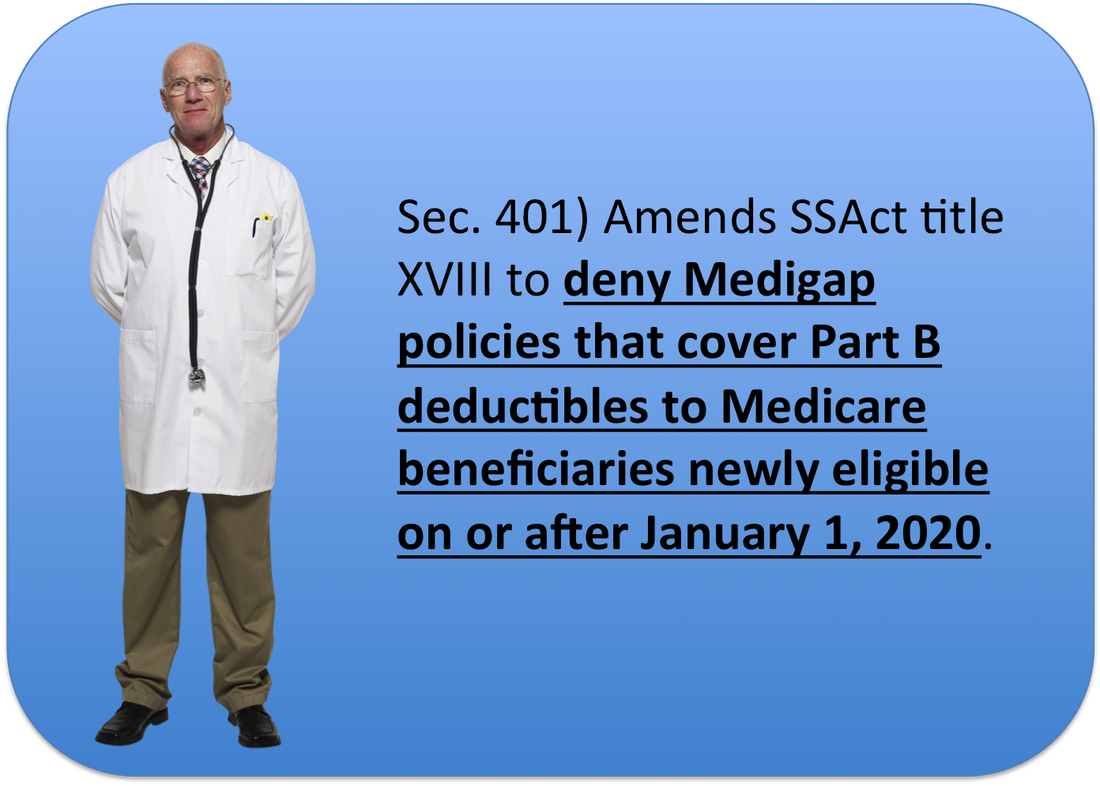

At this time of year, you are probably getting inundated with mail about the Medicare Open Enrollment period. We realize this can be cumbersome and confusing, and we would love the opportunity to be of assistance to help relieve some of this stress for you. Our approach is to educate first, make sure you fully understand how the different plans work, and then recommend the best plans for your specific situation. It is very important to take this opportunity to review your prescription drug plan. There are about 30 different drug cards to choose from, Medicare Part D coverage changes every year, and the Prescription plans change every year. You want to make sure you avoid the dreaded donut hole, if possible. Here is a link to our article with details regarding specific changes to the drug plans in 2016. This year we are offering a NEW online form for all of our Medicare supplement customers to fill in their RX information and we will complete a FREE analysis to find the best drug card available. Call now if you have any additional questions: 856-866-8900 or 908-272-1970  There are a lot of articles on this topic recently, and most are indicating about a 50% increase in Medicare Part B premiums for some individuals in 2016. CLICK HERE for an informative article from Yahoo Finance regarding the potential increases. The good news is that nothing is official yet. Last year, the Department of Health & Human Services announced the Part B changes on October 9, 2014, so it is likely to be around the first or second week of October again this year. Stay tuned for the official release from HHS in the next few weeks. Now, may be a good time to review your Medicare Supplement coverage. Call us now (1-856-866-8900) to see if we can potentially save you $500-$600/year to offset the increases in Part B premiums. “Senior Advisors just saved us over $2000 per year by changing from Plan F to Plan G!” - Ted & Marion, Northfield, NJ What does this mean for you? If you already have a Medigap Plan F or are considering getting a Medigap Plan F, you should be aware of the new law that went into affect on April 16, 2015. There are several provisions in the law (which can be found HERE), but section 401 of the new law is one that you should understand. Essentially, the federal government is no longer allowing newly eligible beneficiaries to obtain a Medigap policy that covers the Part B (Medical) deductible ($147/year in 2015). So Plan F will no longer be available starting January 1, 2020. The Good News... If you have Plan F already, you can keep it and will not be forced to move to another plan since this only affects newly eligible Medicare beneficiaries. The Bad News... The Plan F premium rates will be increasing at a higher rate than the other Plans that are not impacted. Why is this? Each plan is individually rated based on the costs (e.g. claims processed) for that particular plan. So, after 2020, when Plan F is no longer accepting new applicants, the pool of Plan F members will begin to age more so than other plans, which will drive higher proportionate claims cost and thus drive up the premiums for Plan F. So what should you do?We recommend the Medigap Plan G, which has:

Act Now... If you are healthy, it is important that you act now since you will have to go through medical underwriting in order to switch your Medicare Supplement Plan. If you wait until a later point, you risk potential health issues that could prevent you from changing your Supplement plan. Get a Plan G Quote or Call Now to see if you qualify for a Plan G Moorestown Office - 856-866-8900 Cranford Office - 908-272-1970 Regards, Douglas Lubenow President, Senior Advisors info@senior-advisors.com |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed