|

Watch out for Cobra! No, not the Cobra snake... I mean Cobra Insurance plans.

COBRA is Not Primary- Medicare is Primary! If you are on COBRA Insurance coverage and over 65 years old, Medicare is the Primary Insurance for you. This means that your Cobra insurance carrier is not required to pay the first portion of your claims that should be covered by Medicare. Thus, you could owe up to 80% of your costs for Medical Expenses. See more about COBRA here: http://www.dol.gov/ebsa/faqs/faq-consumer-cobra.html Late Enrollment Penalties In addition, you are at risk for late enrollment penalties for Medicare Part B (10% for each 12-month period in which you should have signed up for Part B). See more about Late enrollment penalties here: https://www.medicare.gov/your-medicare-costs/part-b-costs/penalty/part-b-late-enrollment-penalty.html Special Enrollment Window If you are over 65 and leaving an Active Group Medical coverage plan, you will have an 8-month Special Enrollment window to sign-up for Medicare Part B without penalties. It is critical that you sign-up during this 8-month window or you will not be able to sign-up until the annual enrollment window (January 1-March 31) and your coverage will not be effective until July 1. See more about Special enrollment windows here: https://www.medicare.gov/sign-up-change-plans/when-can-i-join-a-health-or-drug-plan/special-circumstances/join-plan-special-circumstances.html My First Medicare Case I officially joined Senior Advisors in June 2015. One of my first Medicare cases was a friend & mentor, whom I play basketball with at a local YMCA... let's just call him "Mike". Mike had left a company that was sold in October of 2014. He was 66 at the time. He went on Cobra benefits starting in October 2014. At that time, it was not made clear to Mike that his Cobra coverage would not be the primary insurance carrier. One afternoon in June 2015, I met with Mike for a cup of coffee. He was providing his guidance about my new role at Senior Advisors, and we stumbled upon his current insurance situation. I felt terrible that he had just exceeded 8-months since he left his prior active insurance coverage, which means he was outside his special enrollment window. I urged him to go down to Social Security asap to beg and plead and see if they would let him sign up for Part B. Mike went down to Social Security the following day and pleaded his case and his confusion regarding his Cobra coverage and coordination with Medicare. Unfortunately, nothing could be done. Heavy exposure for Mike Mike will not be able to sign up for his Medicare Part B until January 2016 and the Part B coverage will not be effective until July 1, 2016. Mike is heavily exposed with his current Cobra coverage and he will be further exposed starting in April 2016 when his Cobra expires. Since Mike is over the age of 65, he will not be able to legally purchase a individual health insurance policy and thus will have no medical coverage from April to June 2016 until his Medicare Part B starts July 2016. Don't be like Mike This is a very common situation for individuals over 65 that have Cobra. The Medicare rules are complicated and confusing. Similar situations apply to individuals on Retiree benefits, who need to sign-up for Medicare Part B and may not be aware of this. If you are over 65 and on Cobra (or Retiree) benefits, and you have any doubts about the right Medicare selections, we would be happy to assist you with the process. Please call us at 856-866-8900 or 908-272-1970. Regards, Justin Lubenow 908-448-5058

0 Comments

Avoid Medicare Mistakes that could cost $8000+!As the summer comes to a close, we start to prepare for the next annual enrollment period for Medicare, which begins on October 15 (and ends December 7). During this period, we HIGHLY recommend individuals on Medicare review their Part D prescription drug coverage and ensure they are in the correct drug plan. Do not assume your current prescription plan is the best plan for you in 2016. Here’s why… An $8,000+ Mistake… Avoided A couple of years ago, we had someone come into our office for assistance with their Medicare coverage. Let’s call him John. After we setup the right Medicare supplement coverage for John, we moved on to the Part D prescription plan discussion. John had ten prescription drugs, and he was extremely adamant about a particular drug card since his neighbor had spoken highly of this particular drug card. (Let’s call it Drug Card 1 for analysis below). We explained that each individual is different and it is imperative to select the right coverage based on an individual’s list of prescriptions. There was still some resistance. Then we showed John the analysis (from medicare.gov) based on his drug list.

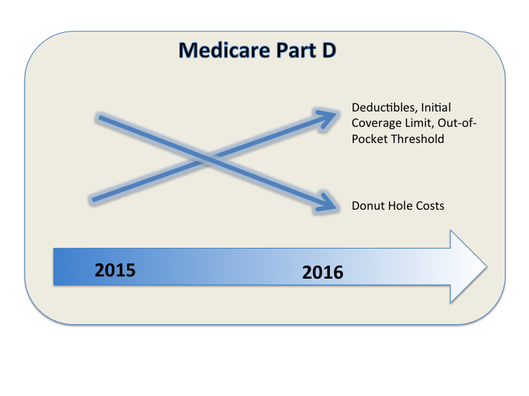

(There was actually another drug card, same insurance carrier as Drug Card 1, that would have been $16k / year!) Needless to say, we were able to convince John that Drug Card 2 was the right card based on his needs. He was extremely happy and continues to be pleased with our service. He contacts us each year during Annual Enrollment to review his Prescription drug card and ensure he has the right plan. Medicare Part D and Prescription Drug Plans change each year, so it is critical to review during the annual enrollment period so you can avoid a mistake that could cost you thousands of dollars per year! Medicare Part D Changes Annually Each year, Medicare changes the benefits provided under Medicare Part D. These changes will most likely impact your annual costs for your Prescription Drug Coverage. Specifically in 2016, here are some key changes for Medicare Part D.

By increasing the initial coverage limit by $350, individuals are less likely to hit the Donut Hole, which is a very good thing.

What does this mean for you? In most cases, this won’t have a material impact. Since generic drugs are generally less costly than brand name drugs, this 7% generic drug cost reduction will not likely have a major impact. (In 2017, the brand name drug cost will drop from 45% to 40%, which should have a larger impact on cost reduction.) See this link for more details on changes in future years. https://www.medicare.gov/part-d/costs/coverage-gap/more-drug-savings-in-2020.html

What does this mean for you? In most cases, this won’t have an impact. Less than 5% of people actually reach this threshold. Catastrophic coverage benefits start when someone exceeds the Out-of-Pocket threshold. In Catastrophic coverage, individuals will pay a much lower fee for their drugs – either 5% of the drug cost or a specific co-pay amount, whichever is greater.

By increasing the Out-Pocket threshold by $150, an individual will need to pay an additional $150 in the donut hole before reaching the reduced cost of drugs in the Catastrophic coverage. All of these Medicare Part D changes in 2016 will have an impact on selecting the right Prescription Drug Card. Prescription Plan Part D Changes Annually In addition to the Medicare Part D changes, the insurance companies change their Prescription drug plans each year. These changes could impact the formulary (which drugs are covered), deductibles, premiums, etc. It is imperative to select the right plan EACH YEAR to avoid the type of mistake mentioned above by John, which could result in thousands of dollars of unnecessary costs! There are 40+ Medicare Part D Prescription plan options and we strongly recommend using the tools on medicare.gov and/or contacting a trusted insurance broker to assist in this process. A FREE Service offered to our clients… We feel very strongly about ensuring our customers have the correct Prescription Drug Card and thus, we provide the option for all of our customers to have their Prescription Drug coverage reviewed annually. We do not receive commission on these transactions. This is purely a service that we offer to ensure our customers have the most cost-effective coverage. If you have any questions about Medicare Part D, Annual Enrollment, or any general Medicare questions, please give us a call at 856-866-8900 or contact us on our website at www.senior-advisors.com If you are familiar with Medicare Supplement Plan F, you should also be educated on Plan G.

There is only one difference in the two plans: Plan F covers the $147 Part B (Medical Outpatient) Deductible that Medicare does not cover, and Plan G does NOT cover this $147 annual deductible. This is the only difference between the types of Supplement Plans and Plan G could generally save you hundreds of dollars per year. Here are two examples based on Aetna Health and Life Insurance non-smoking rates in PA (zip code 19154) Example 1: 65 Year-Old Female

Example 2: 70 Year-Old Male

If you are on a Plan F and have no major health problems, give us a call now at 856-866-8900 (or 908-272-1970) and we can see if we can save you hundreds of dollars per year. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed