|

When you first enroll in Medicare Part B, Medicare provides an initial "Welcome to "Medicare" visit. This initial "Welcome to "Medicare" visit is different than the Annual "Wellness" visits that Medicare provides. There is some confusion about these two types of visits, so we have provided some highlights of what is included with each of these visits below. "Welcome to medicare" visitPer the Medicare website, "This visit includes a review of your medical and social history related to your health and education and counseling about preventive services, including these:

The "Welcome to Medicare" visit must be completed within 12 months of your Medicare Part B effective date. There is no cost to the Medicare Beneficiary for the "Welcome to Medicare" visit, unless the doctor identifies/diagnoses any additional conditions, tests, etc. Annual "Wellness" VisitAAfter the first 12 months on Medicare Part B, the Medicare Beneficiary is entitled to an Annual "Wellness" visit.

Per the Medicare website: "The cognitive impairment assessment is performed to look for signs of Alzheimer's disease or dementia and check for depression and other mood disorders. Your provider may order other tests, if necessary, depending on your general health and medical history. The personalized prevention plan is designed to help prevent disease and disability based on your current health and risk factors. Your provider will ask you to fill out a questionnaire, called a “Health Risk Assessment,” as part of this visit. Answering these questions can help you and your provider develop a personalized prevention plan to help you stay healthy and get the most out of your visit. It can also include:

We hope this provides some clarity about the differences between the "Welcome to Medicare" versus the Annual "Wellness" Visits. It is also important that Provider billing offices understand these differences. We have had some issues with Provider billing offices attempting to bill the Annual "Wellness" visit codes to Medicare when someone was still in their first 12 months of Medicare. This results in declined claims because the Annual Wellness visit is only available once per year starting 12 months after the Part B effective date.

2 Comments

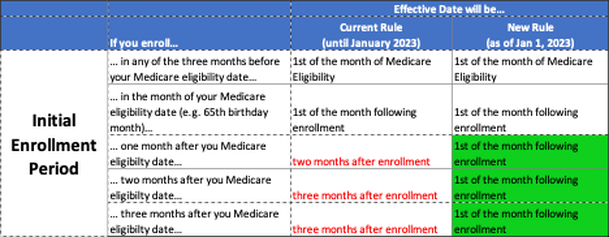

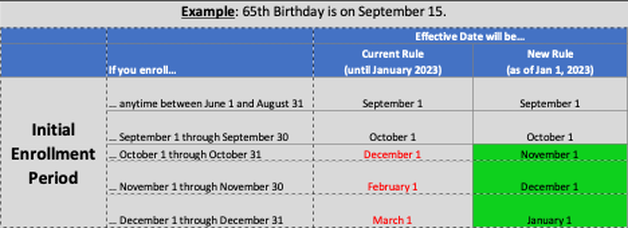

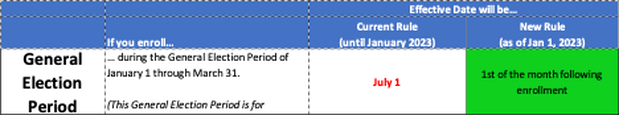

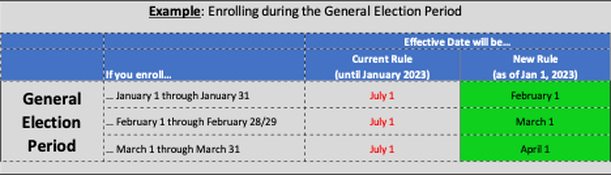

For several years, the Medicare Advisory Group of NAHU has been working on fixing the delayed effective date that occurs for certain Medicare Beneficiaries who enroll during their last three months of their Initial Enrollment Period, or during the General Election Period (January 1 – March 31). We are excited that our proposed fixes were finally implemented in the Consolidated Appropriations Act of 2021. The changes begin on line 21 of Page 2168 of the bill. The new rules will begin on January 1, 2023. Initial Enrollment Period: The Current Rules require a delay of 2-3 months for the Part B effective date when someone enrolls in the three months following their 65th birthday. The New Rules will remove that delay and provide the Part B effective date of the first of the month following enrollment. The table below summarizes the Current rules versus the New rules for the Initial Enrollment Period.  The table below provides an Example for someone who is turning 65 on September 15. General Election Period: The General Election Period of January 1 through March 31 is for a Beneficiary who missed their Initial Enrollment Period and does not have credible coverage. These individuals must enroll during the General Election Period of January 1 through March 31, and the effective date is July 1. With the New Rules coming in January 2023, the Beneficiary will get an effective date of the first of the month following enrollment. The table below summarizes the Current rules versus the New rules for the General Election Period. The table below provides an Example for someone who is enrolling during the General Election Period. We are excited that we have had such a positive impact on Medicare Beneficiaries enrolling during these two time periods and reduced their delays in getting their Medicare Part B coverage! We will continue to work in Washington to address our other key initiatives: Medicare COBRA Trap, Observation Status, and more. According to Social Security, about 21% of married couples, and 45% of unmarried persons rely on Social Security for 90% of their income. This is clearly concerning since Social Security was only intended to provide about a third of your retirement income needs (other two thirds was supposed to be individual savings, and pensions).

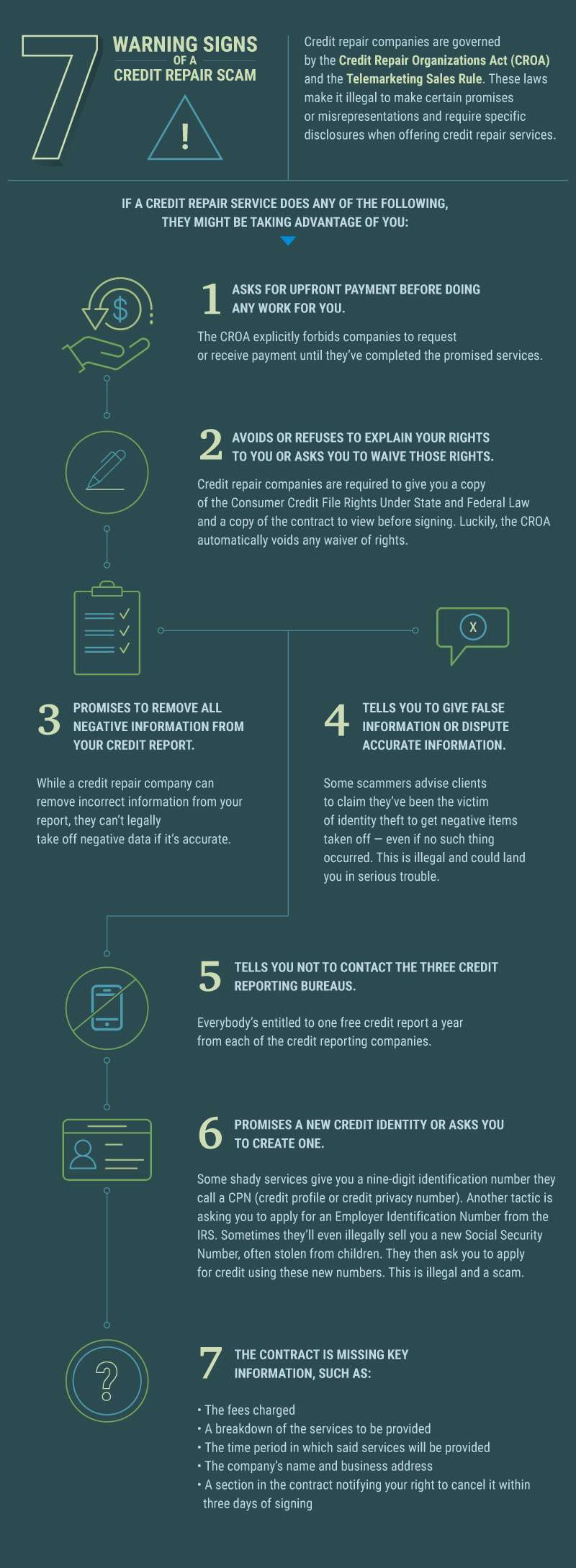

For a lot of retirees, this limited income combined with debt can result in some Credit issues. If you happen to have credit issues, there are numerous providers out there that claim to be able to help repair your credit. It can be difficult to filter through the different options, understand the different services & costs involved. There are also numerous Credit Repair Scams to avoid! Money.com recently published a good article that outlines the 6 best credit repair companies with costs and benefits of each service. The article also does a good job explaining Credit Repair Scams. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed