|

It's that time of year - tax season!

This time of year seems to trigger an inordinate amount of questions related to HSAs (Health Savings Accounts) and Medicare. In this short video, we attempted to address some of these frequently asked questions. Some important topics covered in the video.

We hope you find the video helpful. If so, please Comment on the video, Like the video, and Share the video so others will see it too!

0 Comments

We would like to highlight two important articles in the last couple of months for folks on Medicare.

The KFF article highlights the fact that 99% of Providers still accept Original Medicare. If you have a Medicare Supplement, this means you basically see any of the 99% of Providers across the country. (The highest category of providers that do not accept Medicare are psychiatrists.) The USA Today article discusses recent payment disputes which major health systems in VA, Ohio and California which resulted in certain Provider Systems leaving Medicare Advantage Plans. The other important thing to to consider is the Medical Underwriting required to get into a Medicare Supplement (if you have been on an Advantage Plan for more than a year.) This is explained further in this brief video. CMS just announced the updated Part B premiums for 2024.

Social Security also announces the 2024 Cost of Living Adjustment will be 3.2%

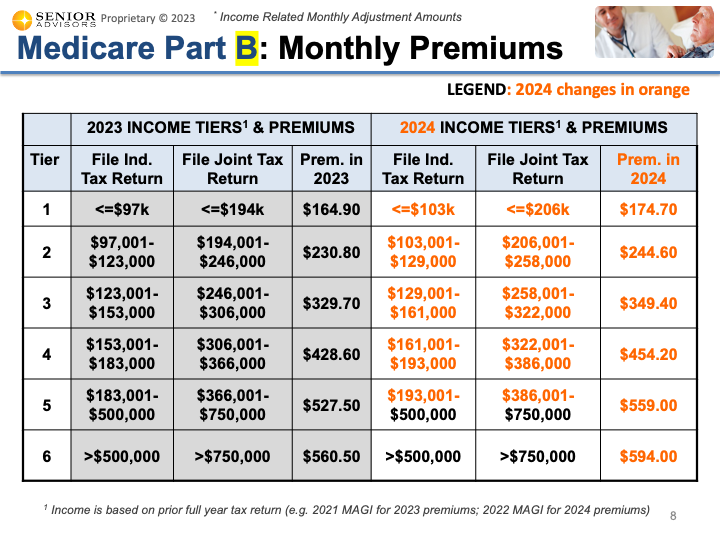

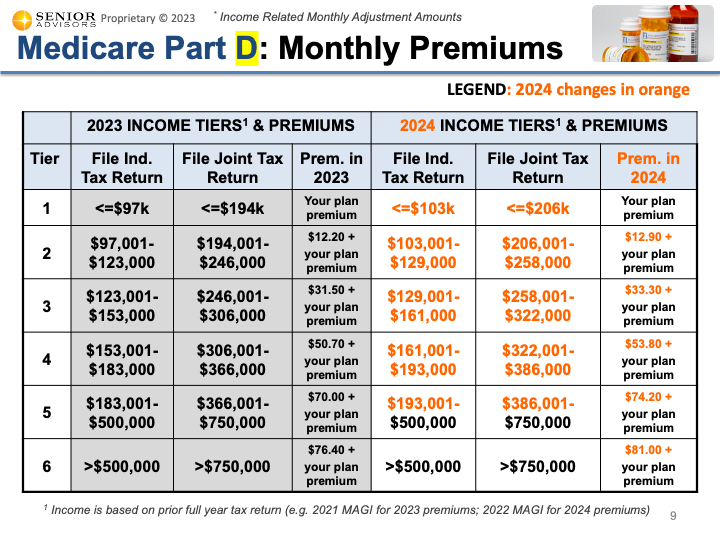

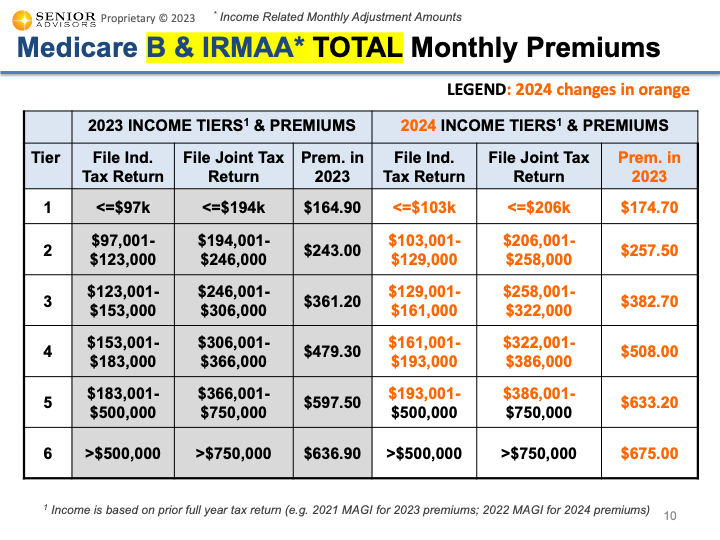

2024 IRMAAs (Income Related Monthly Adjustments) The Income Related Monthly Adjustment Amounts (IRMAAs) were also updated for 2024. You can find the tables below for individuals with income greater than $103,000 (or joint filers with income greater than $206,000). This income is based on your MAGI (Modified Adjusted Gross Income) from your 2022 Tax Return. These IRMAAs only affect about 7% of people with Medicare Part B. If you are in one of the higher income brackets for the Part B IRMAAs, there is an additional IRMAA for the Part D Drug Coverage. The updated table for 2024 can be found below. The table below shows the sum of the Part B Premium, Part B IRMAA, and Part D IRMAA for the higher income brackets for 2024. The other changes for 2024 that were included in the announcement are below.

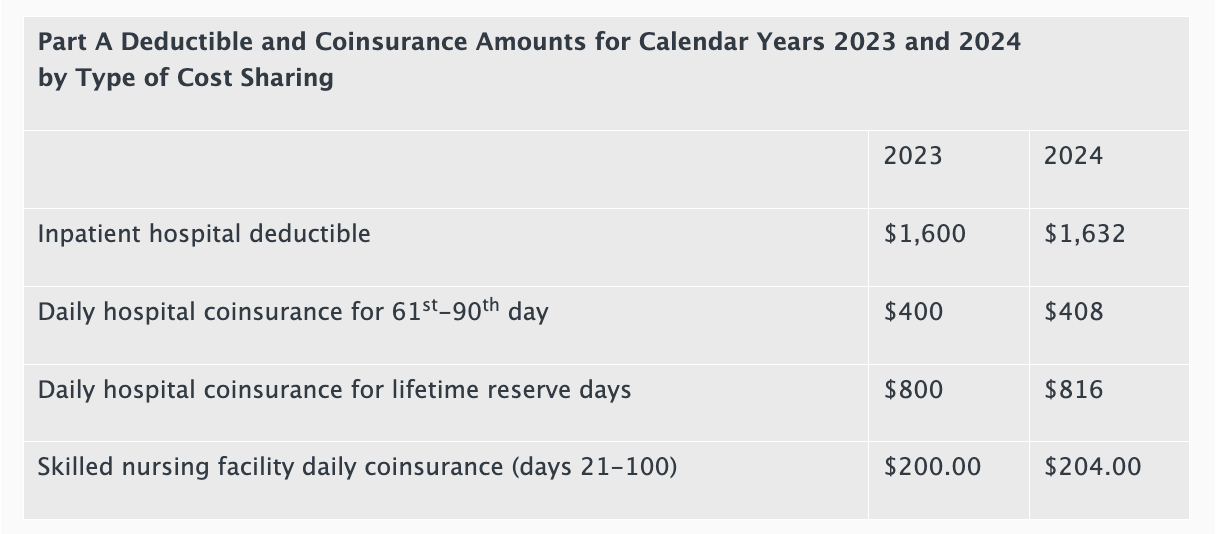

If you have a Medicare Supplement Plan F, Plan G, or Plan N, the Part A cost-sharing is fully covered by the Supplement so these changes below will not impact you. In August of 2022, the Federal Government passed the Inflation Reduction Act bill which included numerous provisions related to Medicare drug pricing.

One of the provisions in this Bill will allow HHS (Health and Human Services) to negotiate drug pricing for the Medicare program. The first 10 drugs were just selected for negotiation and they are listed below. The negotiation will take several years and the new pricing will take effect in 2026.

These are all high-cost drugs that we see each year during our Part D review and recommendations so we are looking forward to the lower prices going forward. However, the impact this will have on the Medicare beneficiary will likely be minimal because of the other changes coming to the Medicare Part D program. Specifically, there will be a cap on Part D out of Pocket expenses of approximately $3,500 in 2024 and $2,000 in 2025. So, the Medicare Beneficiary who is taking these expensive medications in 2026 will likely reach their Maximum out of Pocket expense (with or without the drug price negotiation). We shall see how this all pans out over the next few years. Each year, there are changes to the Part D Prescription Drug Coverage of Medicare. We won't have visibility to the actual Part D Plans until October 1, but there are some structural changes that occur each year with Part D. Key updates for 2024 are below.

Annual Deductible The government sets a maximum deductible amount for the Part D Plans. In 2023, the maximum deductible was $505. In 2024, this is increasing $40 to $545. On most of the Part D Plans, the deductible only applies to higher tiered drugs (e.g. Tiers 3, 4, 5). Also, some Part D Plans have a $0 deductible, or other amounts lower than the maximum deductible. Initial Coverage Level The Initial Coverage Level will increase $370 from $4,660 in 2023 to $5,030 in 2024. This amount is based on the Retail Cost of the Medication for the year (Calendar Year). Most people (about 85%) do not exceed the Initial Coverage Level and thus continue to pay their Copay/Coinsurance amount for the entire year. However, for the people that have very expensive medications that exceed the Initial Coverage Level, they will reach the Part D Coverage Gap, aka Donut Hole where they have to pay 25% the cost of their medications. The increase of $370 to the Initial Coverage level will have a minimal impact on Drug Costs in 2024. Basically, for those 15% of people with expensive medications, there will be a slight delay to reaching the Part D Donut Hole. True Out of Pocket Limit (Tro-oP) The True Out of Pocket limit will increase $600 from $7,400 in 2023 to $8,000 in 2024. The Tro-Op is used to determine when someone exits the Part D Coverage Gap, aka Donut Hole, and moves into Catastrophic Coverage. Big Change in 2024: In 2023 (and prior years), when you reached Catastrophic Coverage, you would still have to pay 5% the cost of your drugs for the rest of the year. In 2024, if you reach Catastrophic Coverage, you will have $0 cost sharing for the rest of the year for your medications. Click the link to the video for a more detailed explanation of these changes, including a detailed example for someone who reaches the Part D Donut Hole. Every year in February or March, we head to Washington D.C. for the annual Capitol Conference for our Association (National Association of Benefits and Insurance Professional, NABIP; formerly National Association of Health Underwriters, NAHU). The last couple of years were not the same (due to COVID), but it was great to be back in person this year. There are key issues (or Talking Points) that our group focuses on each year. We schedule meetings with our Congressman/Congresswoman to discuss these key issues and ask for support to improve the healthcare system. This year, we met with our new Congressman (Tom Kean, Jr) and we focused on the issues mentioned below:

As a member of the Medicare Advisory Group of NABIP, the Medicare issues are always close to my heart so I took the lead in discussing these items with Congressman Kean. He seemed supportive and we look forward to continued discussions to continue to improve the healthcare system for Medicare Beneficiaries and all Americans. CMS COO - Jonathan blumAt this year's conference, I also had the honor of introducing one of our key speakers, Jonathan Blum (CMS Principal Deputy Administrator & Chief Operating Officer). Mr. Blum spoke about some of the changes CMS (Centers for Medicare & Medicaid Services) has been making to reduce Medicare complaints and improve the overall experience. There were loud cheers in the audience when Mr. Blum mentioned the additional work his team is doing to limit the misleading and confusing TV Commercials related to Medicare Plans. He also mentioned the results have already started to show with a large reduction in Medicare complaints from 2021 to 2022. celebritybootblack.com-Dino wright If you are ever in Washington D.C. and you need your shoes shined, Dino Wright is the man to see! Every year, we see Dino at the Hyatt in Capitol Hill and he does an amazing job getting our shoes ready to go. Dino is also an incredibly nice guy and great conversationalist; always enjoy our chats and hearing the updates regarding his children's achievements! https://www.celebritybootblack.com/the-visionary-dino-wright/ At the end of another successful year, we like to do a team dinner with our staff and significant others. In prior year's, we have gone to a nice steakhouse and had a nice meal. This year, we tried something different and hosted at our house with a Private Chef, Brett Smith. It was an amazing meal/experience. I met Brett years ago, training together at a gym. He is a likable, hard-working guy. I began following him on Social Media and watched him start his business in 2021. The pictures of his meals look absolutely amazing so I had to give it a try this year for our team dinner. I don't consider myself a 'foodie' or food critic, so I am not going to go in a lot of detail, but the flavors and presentations were just amazing all night. Brett's assistant, Brandon was also fabulous. He helped prepare the food, serve the food, pour drinks, clean the dishes, and just about anything we needed. He helped make an unforgettable night. In our business (like most small businesses), referrals & testimonials are so important.

If you are looking for a unique & amazing dinner experience, I highly recommend Chef Brett Smith. You can contact Brett directly for more details. 2022 was another busy year for Medicare and for Senior Advisors.

Some of the key highlights can be found in the short video above.

We hope everyone has a fantastic 2023! Every year in Sept/Oct, we send out reminders to our clients to complete their updated Rx form so we can review their Part D Plans for the following year.

Oct 15 to Dec 7 is the one opportunity each year to review and change the Part D Plan for the following year. This is a very important opportunity because the Part D Plans change every year; so even if your drugs haven't changed, your current Part D Plan may not be the best Part D Plan for the following year. Since 2018, we have been tracking the Savings Projections for the Part D Recommendations we send our clients each year. If someone's current Part D Plan is still the most cost-effective Plan for the following year, it is not included in the Savings calculation. The Savings calculation just includes Savings Projection for Part D Recommendations that save people money versus keeping their current Part D Plan. We are very excited that we have saved our clients nearly $10M over the last 5-years with our Annual Part D reviews. Last week, the state of NJ released their 2023 income levels for State Prescription Assistance Programs. These are very helpful programs for individuals that have lower income and expensive medications.

EFFECTIVE JANUARY 1, 2023 The PAAD income eligibility limits for calendar year 2023 are:

The SENIOR GOLD income eligibility limits for calendar year 2023 are:

Application for both programs can be made via the NJ SAVE paper application, or on-line. - MORE INFO CAN BE FOUND HERE - APPLY ONLINE HERE |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed