|

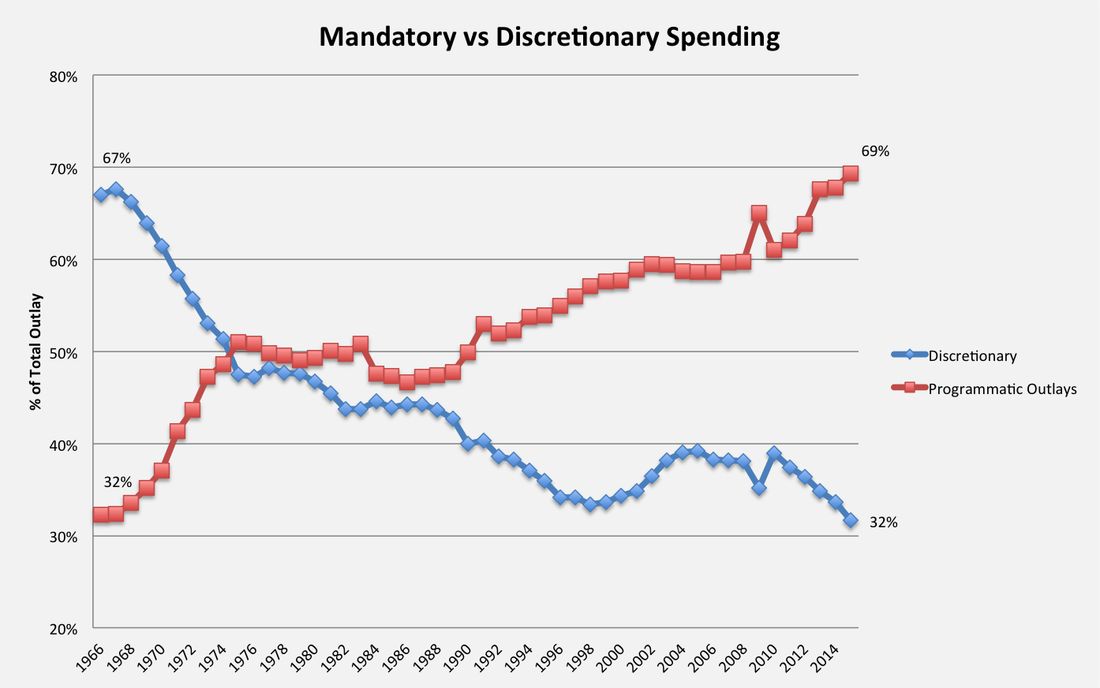

On Monday evening nearly 100 million people watched the first presidential debate. As expected, there was little substance from either candidate. I am not going to pick apart the entire debate but I am going to highlight the biggest economic issue this country is facing, which NEITHER candidate mentioned during the 90-minute debate. (It’s possible that I zoned out during one of the many diatribes and missed it.) What if… …you were making $120,000 per year (decent income, top 20% of income in U.S.), and 32% of your monthly income was immediately deducted each month. So, rather than $10,000 per month in take home pay, you would take-home $6,800 per month. This may not seem that far-fetched because we do have deductions/taxes that are in this realm of proportion. People find a way to pay their mortgage, utilities, food, insurance, and some discretionary spending with these deductions. What if that 32% commitment increased to 70%... ...leaving just $3,000 per month to pay for the same expenses? Would you be able to survive and pay for your home, food, utilities, and other discretionary spending? Would you be stressed? Source: March 2016 CBO Historical Budget Data Mandatory Spending is now 70% of budget and increasing! In 1962, 32% of our U.S. budget went to Mandatory Spending (e.g. Social Security & Medicare) programs, and 67% went to Discretionary Programs (e.g. Military, and Other). In 2015, those percentages flipped to nearly 70% of the U.S. spending is going to mandatory programs, and this % will continue to increase over the next 10-15 years as more and more baby boomers are aging into Social Security & Medicare. Source: March 2016 CBO Historical Budget Data

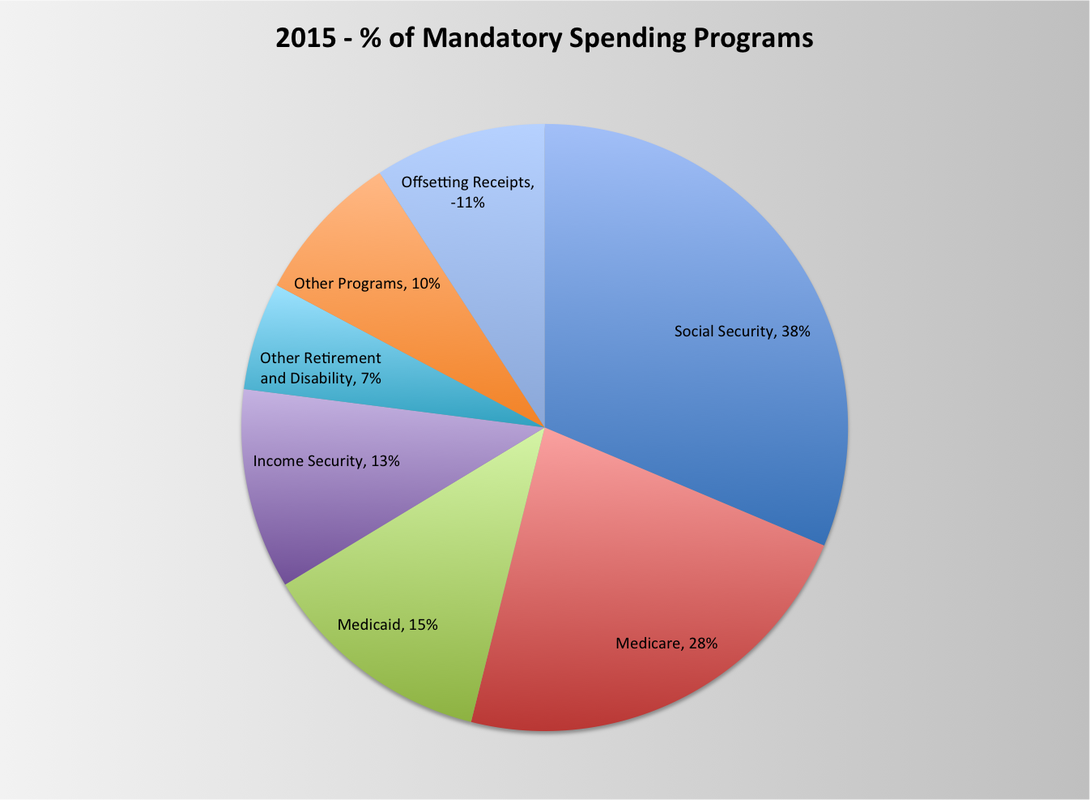

As we peel back the layers within the Mandatory Spending Programs, Medicare + Social Security make up about 2/3 of the Mandatory Spending. If we add in Medicaid, this increases to over 80% of our Mandatory Spending. As more and more dollars go towards Mandatory Spending Programs, we will not have funding for any “Discretionary” expenses such as Infrastructure, Energy, Military, etc. This will create National Security risks and infrastructure challenges that could set us behind other countries. Candidates focus on Economic Growth I understand both candidates are more focused on economic growth. I realize if we can grow the economy by 10-12% per year, these expense issues become less of an issue, because we will have revenues that can offset the increased expenses. But, this is similar to an individual (whose take-home pay dropped 50%) trying to out-earn their debt obligations and continuing to spend the same way. “I will just keep spending more and more on credit cards, but I know that I can make more money to cover the expenses and growing interest in the future.” This is wishful thinking and a recipe for financial disaster. Offending a large population of voters I suspect the campaigns are intentionally avoiding these two key programs (Medicare & Social Security) so they do not create any negative voting impact with a large population of voters. We should all be very concerned that these Programs are just not sustainable, and the longer we wait to address this Major Budget issue, the worse this problem gets and the more painful it will be to address. A few months ago – I wrote an article with some high-level thoughts on addressing the expense issues with these programs without impacting current beneficiaries on Social Security & Medicare. If you are interested, you can read that article here.

0 Comments

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed