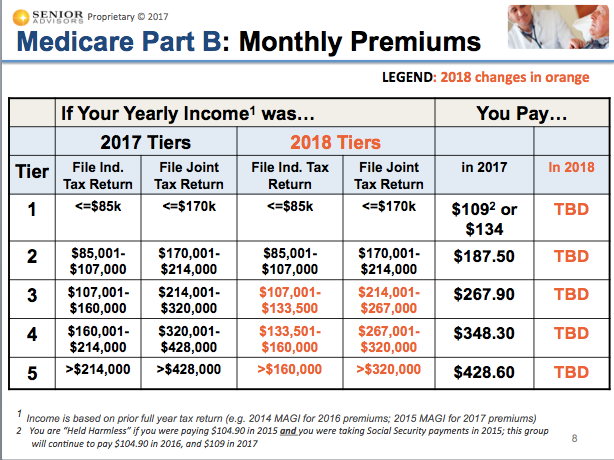

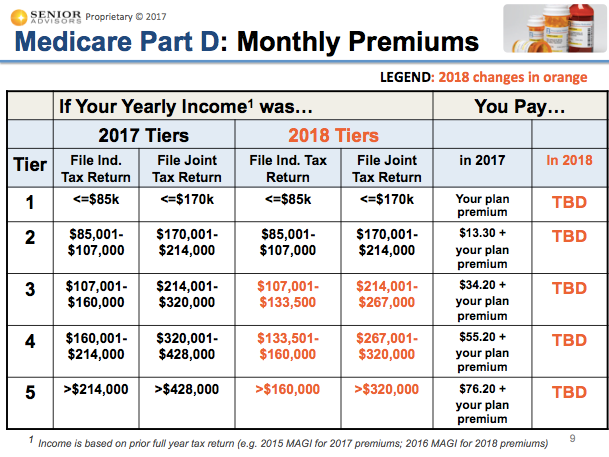

Back in March of 2015, the government passed a bill called, H.R.2 - Medicare Access and CHIP Reauthorization Act of 2015 which is intended to help sustain the long-term viability of the Medicare Program. There were numerous changes in this bill which impacted how physicians get paid on Medicare. The number of changes that impacted Medicare beneficiaries directly was minimal. One of the changes in this bill (Section 401 of the MACRA of 2015) which does impact Medicare Beneficiaries (Changes to Medigap Plan F in 2020) has already been heavily documented and reviewed. Another change (Section 402 of the MACRA of 2015) will impact those individuals whose annual income is between $133,501 and $214,000 (as an individual) or $267,001 and $428,000 (married, filing jointly). Income Related Monthly Adjustments (IRMAs) are required for individuals to pay to the government for their Part B & D premiums if they make more than $85,000 (as an individual) or $170,000 (as a couple). Section 402 of the MACRA of 2015 changed the income thresholds that are used to determine which Tier of IRMA amounts an individual has to pay, effective January 1, 2018. Example of Impact to a Married Couple - increase of $2,400+ in Medicare Premiums! Based on the current IRMA table being used in 2017, a couple making $270,000 (in 2015) would be aligned with the third tier for their Part B and Part D IRMAs in 2017, thus Premiums to the government are below: Illustrative 2017 Premiums:

Based on the IRMA income threshold changes coming in 2018, this couple will likely see an increase of $2,400+ per year in Medicare premiums!* Illustrative 2018 Premiums*:

* We can't know for sure what the actual increase will be since the 2018 Medicare premium amounts have not been released yet, so this example assumes the Part B Premium & Part D IRMA amounts for each income tier do not increase in 2018. Income levels impacted by the IRMA Threshold changesYOU ARE IMPACTED BY THESE IRMA CHANGES, If you're income is:

YOU ARE NOT IMPACTED BY THESE IRMA CHANGES If you're income is:

If you have any further questions about how these changes to the IRMA tables in 2018, you can give us a call at 908-272-1970 to learn more.

1 Comment

|

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed