|

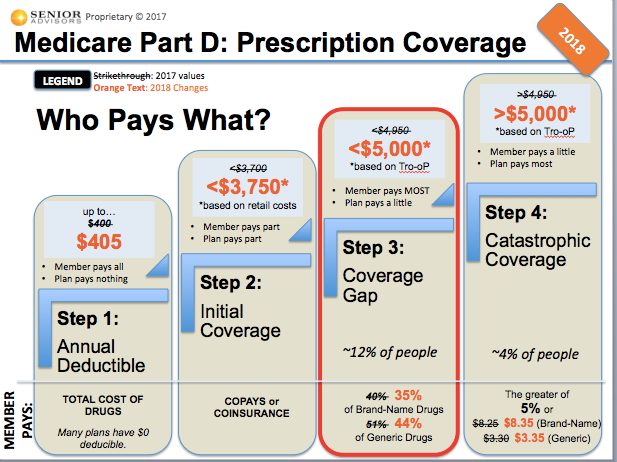

Medicare Part D Changes Annually Each year, Medicare changes the benefits provided under Medicare Part D. These changes will most likely impact your annual costs for your Prescription Drug Coverage. Specifically in 2018, here are some key changes for Medicare Part D.

By increasing the initial coverage limit by $50, this is a minor improvement which lowers the probability of reaching (or delays the timing to reach) the donut hole , which is a good thing.

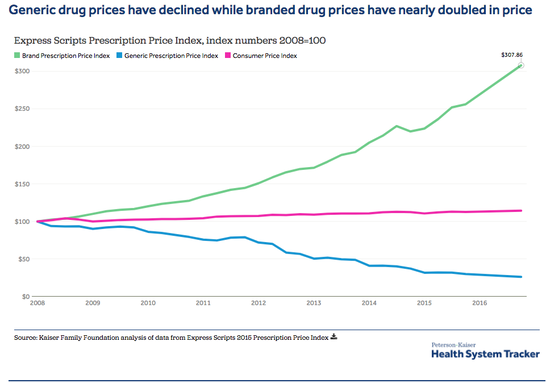

What does this mean for you? The cost sharing % an individual has to pay continues to drop each year until we plateau in 2020 at 25% cost sharing for both Brand name and Generic Drugs. In theory, this is a great thing since the % of cost sharing to the individual continues to drop each year. In practicality, the retail cost of Prescription Drugs continues to rise at a significant rate which tends to offset the savings anticipated with the annual improvements to the Donut Hole. See this link for more details on changes in future years to the Donut Hole.

https://www.medicare.gov/part-d/costs/coverage-gap/more-drug-savings-in-2020.html

In Catastrophic coverage, individuals will pay a much lower fee for their drugs – either 5% of the drug cost or a specific co-pay amount, whichever is greater.

By increasing the Out-Pocket threshold by $50, this will have a minor impact on the length of time an individual will remain in the donut hole before exiting into the Catastrophic coverage. All of these Medicare Part D changes in 2018 will have an impact on selecting the right Prescription Drug Card. Prescription Plan Part D Changes Annually In addition to the Medicare Part D changes, the insurance companies change their Prescription drug plans each year. These changes could impact the formulary (which drugs are covered), deductibles, premiums, etc. It is imperative to select the right plan EACH YEAR to avoid the type of mistakes which could result in thousands of dollars of unnecessary costs! There are about 25 Medicare Part D Prescription plan options in each state, and we strongly recommend using the tools on medicare.gov and/or contacting a trusted insurance broker to assist in this process. A FREE Service offered to our clients… We feel very strongly about ensuring our clients have the correct Prescription Drug Card and thus, we provide the option for all of our clients to have their Prescription Drug coverage reviewed annually. Click Here to Find out more about our FREE RX Analysis program.

12 Comments

Sorin Weissman

8/17/2017 02:16:34 pm

Please keep me informed of any changes.

Reply

Justin Lubenow

8/17/2017 02:23:01 pm

Hi Sorin,

Reply

Lona Alexis Duboi

2/17/2018 11:34:20 pm

Navigating the part D plan is confusing.I thank you for your step by step walk through

Reply

Justin Lubenow

2/18/2018 06:35:07 am

Hi Lona,

Ginny Rees

9/6/2017 01:15:26 pm

I am very upset to be told that the cost of Spiriva has jumped drastically to over $100/mo! Why was I not advised of this when I signed up for coverage? There is no way I can squeeze that much out of my SS check along with the rest of my expenses. If I don't take this RX I will be put in a position of not breathing properly and whatever consequences this will carry. Please help!

Reply

Justin Lubenow

9/6/2017 01:21:39 pm

Hi Ginny,

Reply

Ginny Rees

11/21/2017 09:58:19 am

Very disconcerting. Thank you for the explanation ~ I overlooked that damn “donut hole”. Wouldn’t it be nice (for everyone) if medical coverage actually COVERED what it should? God bless America, but not it’s greedy politicians. 👎🏻

Reply

Ginny Rees

11/21/2017 10:09:35 am

I have unsuccessfully tried to find help for RX assistance and seem to make “too much” to qualify.

Reply

Justin Lubenow

11/21/2017 10:31:49 am

Hello Ginny,

Reply

Ginny Rees

11/21/2017 12:24:04 pm

Do you really think that helps.?....not so much. One needs to be destitute or very well heeled in the US to be able to get by. 7/22/2019 02:37:09 pm

With Insurance we know that Price Counts, Coverage Matters.

Reply

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed