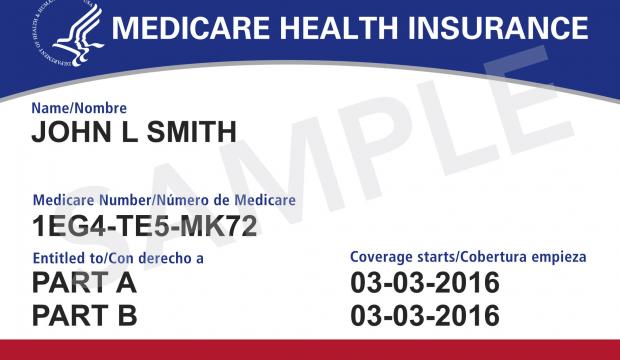

Happy belated New Year! (I think the rule should be you can’t say "Happy New Year" after January 7, but I am taking the liberty here because this is our first newsletter of 2018.) Most of the changes coming in 2018 have already been announced in 2017 and written in our blog, but I wanted to take the opportunity to REMIND everyone of some of the changes coming in 2018 since the holidays tend to wipe out some of our memories from the prior year :-) (1) New Medicare Cards are Coming starting in April! - don't worry if your new card doesn't arrive in April. The whole mailing process will take up to 12 months (until April of 2019) to mail out the updated 60 million ID cards. You can read more about the new Medicare cards here. (2) Part B Premium and Deductible in 2018 - Most people will remain at $134/month for the Part B Premium, but there are some individuals and couples that are getting a SIGNIFICANT increase in 2018. Also the Part B deductible remains at $183 in 2018. So, if you have a Medigap Plan G, your ONLY medical out-of-pocket cost will remain at $183 in 2018. Read more here.  (3) Part D and the Donut Hole - The donut hole keeps "shrinking" each year until 2020, so in theory this should help reduce your RX costs in 2018 if you reach the donut hole. Unfortunately, the reduction in donut hole % cost seems to be outweighed by the increase in RX costs each year. Read more here. (4) Social Security and Medicare Withholding - Per a recent article in Forbes, "Remember that in addition to income tax withholding, your pay is also subject to withholding for FICA (Social Security and Medicare) taxes. For 2018, the employee portion of Social Security tax is 6.2% with a taxable wage base of $128,400 (wages over that amount are not subject to Social Security tax) while the employee portion of Medicare tax is 1.45% with no wage base limit (all wages are subject to Medicare tax). There is an additional Medicare surtax (.9%) tacked on to wages which exceed $200,000, or $250,000 for married taxpayers." Read more here. Upcoming Free Medicare WorkshopsWe present about 40-50 Medicare Workshops per year to help educate individuals on Medicare. We provide public workshops at libraries, community centers, 55+ communities; and we also provide Private workshops to corporations with large populations of employees age 64+ , We also teach CE and CPE classes on Medicare to help educate professional insurance agents and CPAs regarding the complexities of Medicare. You can find more information and sign-up for a Free Workshop or Request a Workshop for your location from our website. If you would prefer, you can actually watch the workshop video which was aired by a local TV station back in 2016. There have been some changes to the content since 2016, but they are minor. "Lauren was very thorough and informative..." Last week, I received a letter from one of our happy clients and I wanted to share with you - this is exactly why we do what we do here at Senior Advisors. It is extremely rewarding to know that we are truly helping people navigate the Medicare maze! Great job Lauren! Are you Turning 65? Do you have a Medigap Plan F? Retiring?A quick 5-minute call will help you determine if you qualify for a Medicare Supplement Plan G.

Call Now to get a quote and see if you qualify:

Also - you can watch this short 4-minute video which explains the ONLY difference between Plan F and Plan G and the upcoming changes coming in 2020 We hope you have started your 2018 with a bang and continue to have a great year!

0 Comments

Leave a Reply. |

Justin LubenowSee bio here Categories |

|

Our Services

|

Company

|

|

Moorestown Office | 214 W. Main Street, Suite 101, Moorestown, NJ 08057 | Tel:856-866-8900

Servicing Moorestown, Cherry Hill, Mount Laurel, Haddonfield, Voorhees, Medford, Marlton, Philadelphia, surrounding towns, and licensed in 30+ other states as well. Cranford Office | 15 Alden Street, Suite 8, Cranford, NJ 07016 | Tel: 908-272-1970 Servicing Cranford, Westfield, Summit, Scotch Plains, Mountainside, Berkeley Heights, New Providence, Basking Ridge, surrounding towns, and licensed in 30+ other states as well. Phoenix Office | 20715 N Pima Rd, Suite 108, Scottsdale, AZ 85255 | Tel: 602- 935-8444 Servicing Phoenix, Scottsdale, Peoria, Sun City, Sun City West, Paradise Valley, Fountain Hills, Cave Creek, surrounding towns and licensed in 30+ other states as well. Email: info@senior-advisors.com (Se Habla Español -Tel: 908.481.5678) |

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options. Not connected with or endorsed by the United States government or the federal Medicare program.

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

Copyright © 2023 Senior Advisors, LLC | Licensing & Legal | Privacy Policy

RSS Feed

RSS Feed